Most people have not got around to writing a Will. According to a recent survey 64% of adults in the US do not have a Last Will and Testament. The more significant concern though is that in the younger age groups (people under 35) the percentage is much higher.

90% of Americans aged 18-34 do not have a Will

80% of Americans aged 35-44 do not have a Will

83% of single Americans with children do not have a Will

The primary reason for this is that young single people simply don’t feel that they need a Will, and of those that do, writing a Will is certainly not an urgent task. It ends up being something that they simply haven’t “gotten around to”.

Here are some considerations for young single people who fall into one of these two camps; the deniers and the procrastinators.

1. Wills should not be written in contemplation of death

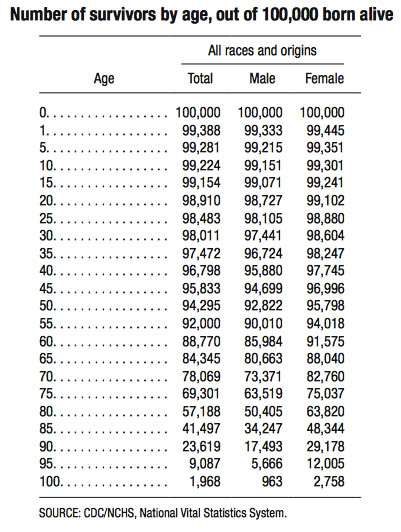

The chances are you are not going to die. I saw this fascinating table published by the CDC which illustrates very clearly your chance of dying by a certain age. You can see that you only have about a 2.5% chance of dying before the age of 35.

So why on earth would you consider writing a Will?

I can understand the objection if you think that the Will is going to cost you several hundred dollars, and several hundred more every time you update it. This would imply that you have completely wasted your money preparing a document that serves absolutely no purpose.

But writing a Will doesn’t have to be that expensive, and updating the document can now be done quickly and affordably (or at no charge).

You should not plan on writing a Will once in your lifetime, and plan to do this just before you die. A Will is part of sensible financial planning and should be one of the documents in your financial portfolio. It will be reviewed once in a while particularly when your circumstances change, and should be updated to reflect this change in circumstances. But there should never be a time in your life when you are without an up-to-date Last Will and Testament.

2. Don’t assume that you don’t need a plan because you’re not worth anything

There is more to writing a Will than dividing up the possessions that you have. You may look around your apartment and think that you have a bed and a guitar, maybe a used car and not much else, but even under these circumstances you should still be writing a Will for a couple of reasons.

Firstly, you are probably not going to die today (see point 1), so your Will is going to come into effect some time in the future. But there is a good chance that if something were to happen to you, it could be as a result of an accident. And there’s also a chance that somebody would be found liable for that accident. Which means that it is quite likely that your estate (the value of everything you own after you die) is worth a whole lot more than the week before you died. If you randomly search the internet for wrongful death settlements you’ll see for example that in Maryland, the average was $4.1M. This is just one example, but the message is that you have absolutely no idea how much you will be worth when you die, so you should be writing a Will.

3. Don’t wait until your life settles

We often hear of people putting of the process of writing a Will because they are expecting something to happen in their life. They are planning to get married, they are thinking of buying a house, they might be having children in the future. I spoke to somebody recently who said “fortunately, I don’t need a Will yet”.

You cannot wait until your life settles down before writing a Will. Your life will change, and it will not stop changing. We are often asked questions like “I am expecting a baby in August, should I hold off writing a Will?”. The answer is no. Write your Will now, and then update it in August. You should never be without a Will.

Now if you were using a lawyer to prepare your Will, there is a cost consideration because the Will is going to cost you several hundred dollars, and the update is going to cost you another few hundred dollars.

Some lawyers try to get around this by “future-proofing” the Will be including terms like “all surviving children” to accommodate any children who are not alive at the time of writing the Will. There are shortcomings to this approach though, as your Will should include the appointment of guardians, and setting up of minor trusts.

If you use a Will writing service like the one at USLegalWills.com, you can create your Will for $39.95, and then update it in six months at no additional charge. So your Will is always going to reflect your current situation.

4. You can name your most important appointments

There is more to writing a Will than simply dividing up your possessions. You have important appointments to make including the appointment of an Executor. You can decide who you prefer to take care of all of the administrative details of your estate including dividing your assets and possessions which may be more than you think (see point 2).

You may feel that your parents would be the obvious choice here, but they may be grieving, or they may not have the skills or aptitude to deal with the paperwork. If they are aging you may not want them to be dealing with creditors, the IRS and the court system. Perhaps there is somebody more skilled and equipped to be taking care of everything for you. Ultimately it should be your choice, but without a Will, the courts will appoint somebody.

5. Your beneficiaries may not be obvious

Without writing a Will, you will have died “intestate” and your estate will be divided according to your State rules. In most cases, if you do not have a spouse or children, your parents will receive everything. You may however feel that it is more appropriate for your siblings to receive something at their time of life than your aging parents.

There are family dynamics to consider, and you may have a great relationship with your nephew, or your girlfriend or boyfriend (who would receive absolutely nothing if you died without writing a Will).

Of course, if you wanted everything to go to your parents, then the end result will be similar whether or not you have written a Will, but you are missing a great opportunity to take control of the distribution of your estate.

6. You may want to consider charitable donations

Following on from point 6 is that your Will is a great time to think about charitable giving. You have an opportunity to contribute to a social cause, community project, education, preservation, the environment, church, healthcare, the list goes on. It’s an unfortunate wasted opportunity to not at least think about charitable giving as part of your estate plan.

7. You can designate PoA and Healthcare PoA

Writing a Will is just one part of your estate plan. You should also be considering preparing an Advance Directive, naming a Healthcare Proxy through a Healthcare Power of Attorney and creating a financial Power of Attorney. These documents all come into effect if you are incapacitated and unable to speak for yourself.

There have been many family disputes arising from the tough medical decisions that have to be made when you are incapacitated. It is the most difficult time for families to be faced with these decisions, so your Advance Directives give you an opportunity to proactively voice your opinion, and also designate an ultimate decision maker.

The same applies to your funeral wishes. Families can often disagree on the appropriate tone and style of any funeral ceremony. Your estate plan can let everybody know your view, and can help your loved ones make decisions when they are at their most vulnerable.

8. You are more likely to have digital assets

There is something special about young people in the realm of estate planning and this is the management of digital assets. Generally younger people have a far greater digital footprint that needs to be managed after they have died.

There are broadly speaking three categories of digital assets;

Your accounts that simply need to be managed for the sake of good housekeeping. Most obviously your social media accounts and services like LinkedIn, Twitter. It is most disconcerting for your friends and family to be prompted to congratulate you on a work anniversary when you passed away six months ago. You should document these accounts and designate a person to take care of them. Each social network has its own policy for handling accounts of deceased members and Facebook recently implemented an “in memoriam” page status.

You are also likely to have accounts that have emotional value that should be passed to a beneficiary. Accounts like photo storage or even perhaps email. You should give your Executor your login credentials to sites like Flickr and Instagram and other places that you have used to document your life, and clearly designate a beneficiary for your online photos and videos.

Finally you may have digital assets that have genuine financial value. A YouTube channel, an Adsense account, Blogging revenues, domain names, Amazon associates. There are countless ways to be generating a passive income so if you have assets in a PayPal account your Executor should know about it. Domain names and websites are particularly important as they can lapse if they are not renewed and a quick look at Flippa will give you an idea of how much they can be worth.

In summary

There is really no advantage waiting before writing a Will. It is a very powerful document that allows you to make key appointments, determine the distribution of your estate, and take care of your digital assets. It would be a mistake to wait until you were about to die for two significant reasons; firstly, you probably won’t know you are about to die, and secondly there is a good chance that you will not have the testamentary capacity at that point to prepare a Will.

We receive calls like this all the time “my mother is now very confused and needs a Will, how can she prepare one?”. The short answer is “with much difficulty”. The longer answer is “why on earth did she wait so long? she could have written her first Will 70 years ago and updated it through her life as her circumstances changed”

The process of writing a Will

Writing a Will is not a complicated business, and you do not need to know anything about estate planning law. Using a Will writing service like the one at USLegalWills.com you will be guided through the process with simple questions; who do you want to take care of your estate? how would you want things to be distributed? do you have any particular items that you want to go to specific individuals?

Copyright: moovstock / 123RF Stock Photo

Once you have stepped through the service, you will just download your document as a PDF file and print it in the presence of two witnesses (who cannot have anything to gain from the contents of the Will). Once it is signed and witnessed, then you have your legal Will all taken care of.

If your personal or financial circumstances change, or the circumstances change for anybody named in your Will updates are easy. Supposing you have named one of your parents as your Executor, but now they seem to be slowing down, and you are not sure that they still have the energy to take care of your estate administration. You can simply login to your account, update the name of your Executor, print the new document and then sign it in the presence of two witnesses to have an up-to-date Will that reflects your new situation.

Writing a Will is not for the aged, yet 90% of Americans under the age of 35 have not taken this critical step, even though the process only takes about 20 minutes. If you have any questions we have online help every step of the way and a support team ready to answer your email and take your calls.

Do the responsible thing and start writing a Will today.

- Testamentary Trusts – what are they and how are they created? - May 9, 2024

- Every document you need for a complete estate plan. - October 29, 2020

- Estate Planning in troubled times - April 3, 2020