You probably understand the importance of having a Will, but it is possible that you have been advised that you also need a Trust. But the relationship between Wills and Trusts can be a complicated one because the word “Trust” is used to describe a number of very different things. In this article, we will aim to provide you with all of the information that you need to understand the role of “Testamentary Trusts.“

What is a Trust?

A Trust is set up to allow one person to manage the assets on behalf of somebody else. There are three roles that are set up when a trust is created. The person setting up the Trust is the Grantor is the entity that establishes a trust. There are many other names for the Grantor including: donor, settlor, trustor, and trustmaker.

The Trust is then managed by a “Trustee”. On behalf of a “Beneficiary”. For example, in the most common testamentary Trust, you (the grantor) can leave your entire estate in your Will to your 12 year old child, but the assets will have to be managed by a responsible Trustee on behalf of the child (the beneficiary).

What are the basic types of Trust?

There are two broad categories of Trust: Living Trusts, and Testamentary Trusts. A Living Trust is established while you are still alive. It can be “revocable” or “irrevocable”. Most commonly a Living Trust is set up as an estate planning tool to move assets out of the estate covered by the Will. A beneficiary is named directly on the Trust allowing these assets to go to the beneficiary without incurring probate fees or being wrapped up in the probate process. A detailed discussion on the pros and cons of Living Trusts is beyond the scope of this article.

It can be complicated to set up a Revocable Living Trust and usually requires the insights of a skilled estate planning attorney. You would need to manage assets going in and out of the trust, and update the trust over time. This is a difficult task for a layperson with limited knowledge of estate planning law.

Testamentary Trusts on the other hand, are usually described in a Will and instruct the Executor of the Will to set up the trust for the benefit of a particular beneficiary, with a Trustee named to manage the trust.

How do I create a Testamentary Trust?

To create a Testamentary Trust, the first step is to prepare a Will. You can do this either by working with an estate planning attorney, or by using an online Will writing service like the one offered at USLegalWills.com. Your Will allows you to name an Executor, describe the distribution of your assets, name guardians for children if appropriate, and also instruct the Executor to set up trusts for the management of any bequests in the estate. After you have died, your Executor will work with a bank or other financial institution to set up the trust, with themselves as the Trustee. They will then distribute the funds within the Trust to the beneficiaries according to your instructions in the Will.

What types of Testamentary Trust are there?

At USLegalWills.com we support a variety of Testamentary Trusts. The most frequently used is the Trust for a Minor Beneficiary.

Trust for a Minor Beneficiary

Legally, you cannot leave an inheritance directly to a minor – it doesn’t make sense to give half a million dollars to a four year old. It must be put into trust and a Trustee will have to manage that trust for the benefit of the child as they grow up.

Even if no trust is set up in the Will, a Trust will still need to be set up for the young child. But by putting the trust into the Will you are able to create more controls within the trust.

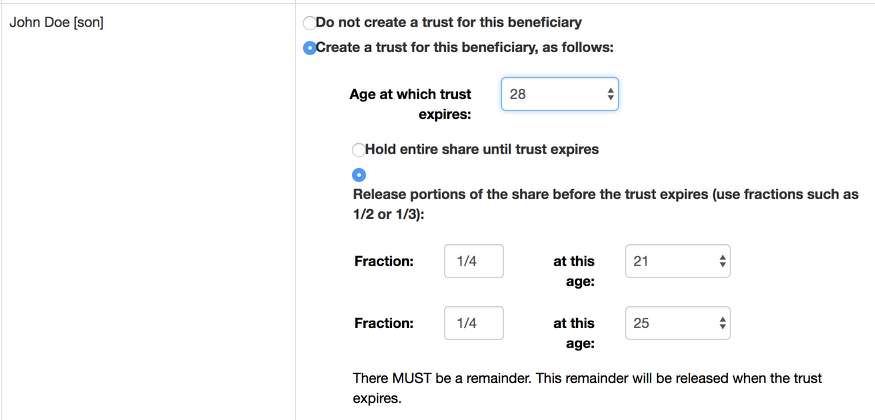

Most obviously, at USLegalWills.com we allow you to extend the duration of the trust beyond the age of Majority for your State. You may feel that 18 years old is too young to inherit a large sum of money, and so at USLegalWills.com you can extend this age out as far as 35 years of age.

The Trust section of the Will service at USLegalWills.com actually goes beyond that and allows you to split the inheritance over a number of ages. For example, you may want the child to receive a quarter of their inheritance at 21, another quarter at 25, and the remaining half at 28. This is all possible using the service at USLegalWills.com.

Unlike many other service providers, we also allow you to describe different trust terms for different minor beneficiaries. If your children have different levels of skill and responsibility with money, you may want them to receive their inheritance at different ages. Or, you may have one child older than the other, and want them to both receive their inheritance at the same time, rather than at the same age. You are able to do this when creating the Trust for the Minor beneficiary at USLegalWills.com.

Pet Trust

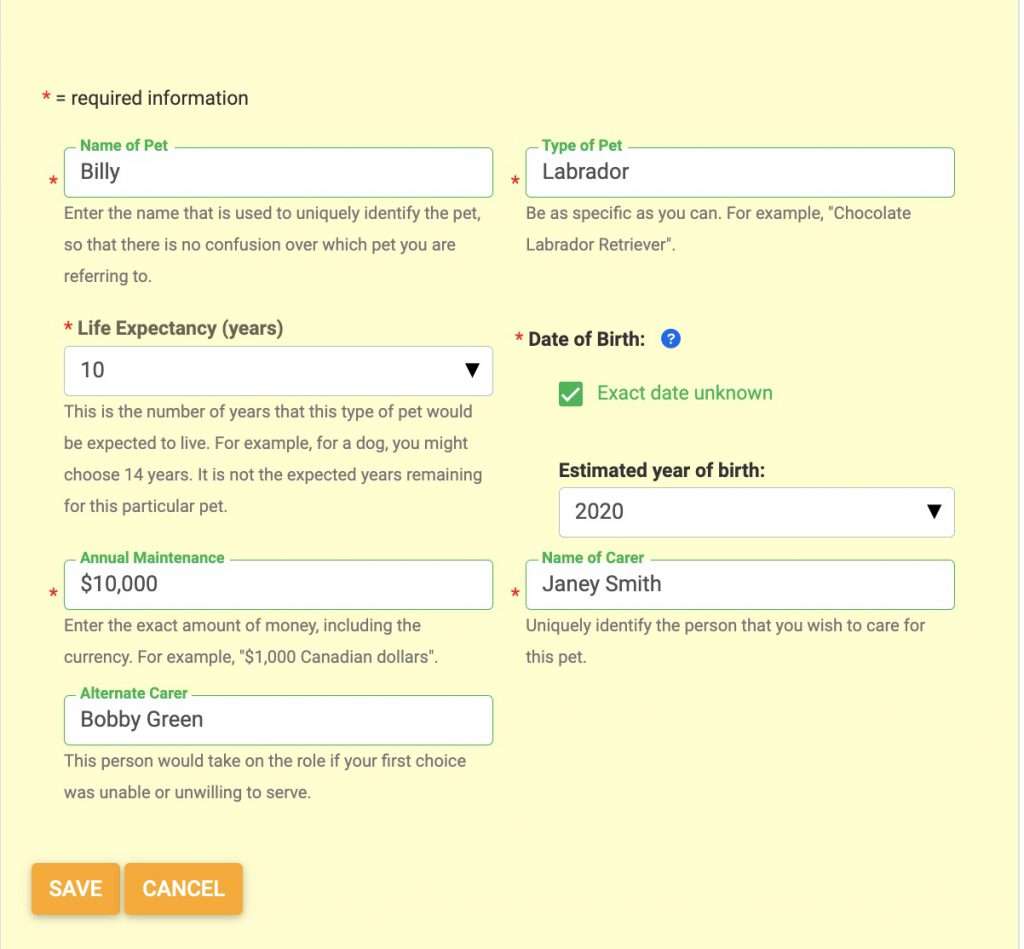

According to US Law, a pet cannot receive an inheritance directly – a pet is considered a possession. It would be like leaving $5,000 to your car. However, you can leave your pet to a beneficiary. There are obviously costs associated with taking on the care of a pet, and so you can leave a sum of money to the beneficiary on the condition that they care for your pet. This is somewhat like a trust arrangement, and we support this at USLegalWills.com.

It is important to note that the trust doesn’t simply give a fixed amount to the pet carer, but the amount is calculated based on the life expectancy of the animal and its age.

The total cost associated with caring for a 2 year old dog is very different to the total cost of caring for a 14 year old dog.

Lifetime Interest Trusts

This is a very important trust clause that is supported at USLegalWills.com, but not at most other online service providers. It is particularly important for “blended families”. That is, when one spouse is not the biological parent of the other spouse’s children. Usually in the case of a second marriage.

If your partner is not the biological parent of your children, and you leave everything to your partner in your Will, there is every chance that they may survive you for a significant period of time. For example, supposing you leave everything to your spouse, and they outlive you by ten years. They may even become involved in a new relationship.

Remember your partner is not the parent of your children, who may even be adults. Ten years after your death your partner may have very little involvement with your children, and they probably would not include YOUR children in THEIR Will.

In this situation, when your partner dies, their entire estate is distributed according to their Will, but their estate includes everything that they inherited from you. This means that your own children will be entirely disinherited from your estate. It is quite likely that they will receive nothing from your estate at all.

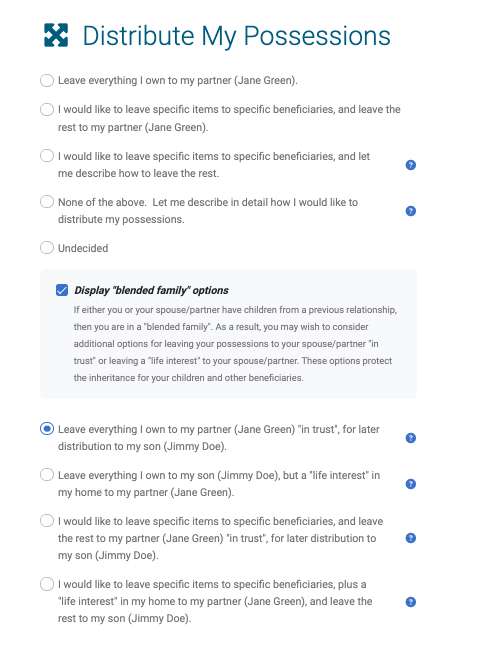

Setting up a Lifetime interest trust at USLegalWills

When you step through the service at USLegalWills.com you get to the first page prompting you to consider the distribution of your estate. On this page, we have an option to select “Display Blended Family Options”

The description of this option makes it clear “If either you or your spouse/partner have children from a previous relationship, then you are in a “blended family”. As a result, you may wish to consider additional options for leaving your possessions to your spouse/partner “in trust” or leaving a “life interest” to your spouse/partner. These options protect the inheritance for your children and other beneficiaries.”

What types of Testamentary Trusts are not supported at USLegalWills.com?

There are some well known types of trust not supported through the service at USLegalWills.com.

Spendthrift Trust

A Spendthrift trust is usually set up to give somebody an inheritance who is unable to control their spending. They have access to the inheritance but only through a gatekeeper (the Trustee) who has to approve the release of any funds. This type of trust also protects the funds from any creditors who have a claim against the beneficiary.

For example, your nephew owes a PayDay loan company $100,000. You want to leave them an inheritance but without a spendthrift trust, the inheritance will be immediately claimed by the PayDay loan company who are a creditor. If your Will creates a Spendthrift trust, the creditor would not have direct access to the inheritance.

Special Needs Trust (SNT)

If a beneficiary has special needs and in receipt of any government benefits, for example Medicaid or Supplemental Security Income (SSI), a large inheritance could immediately disqualify them from these benefits.

By putting the inheritance into a Special Needs Trust you can provide for the beneficiary without the inheritance counting against any benefits that they may be receiving.

Is it difficult to set up a Testamentary Trust?

A Testamentary Trust is set up within a Will. In fact, if you use a service like the one at USLegalWills.com you can include instruction to set up a Testamentary Trust without even knowing it. If you select the Blended Family options in the distribution of your estate, or use the “Trusts for Minor Beneficiaries” section, then your Executor will be instructed to create a trust at a bank. The Will would include all of the instruction that they need to create this.

In summary, it is very, very easy to include instruction for a testamentary trust in your Will.

How much does it cost to create a Testamentary Trust?

The Will service at USLegalWills.com costs $49.95 to prepare a Will. The complexity of the Will does not change the price and so you can create a Will that includes multiple trusts for minor beneficiaries, and a lifetime interest for your spouse, all for $49.95. This includes one year of unlimited updates to the document.

We encourage you to get started now. Prepare your Will, and consider the options to include testamentary trusts on the appropriate pages.

- Testamentary Trusts – what are they and how are they created? - May 9, 2024

- Every document you need for a complete estate plan. - October 29, 2020

- Estate Planning in troubled times - April 3, 2020