You are already doing better than the vast majority of adults in the US. You know that you need a Will, and you are starting to do something about it. You have started researching the approaches to preparing a simple Will, and now you are thoroughly confused. How can it be that the same simple Will can cost absolutely nothing on some websites, and can cost a thousand dollars with an estate planning attorney. What exactly will you be getting in each case? and how much should you really be paying to write a simple Last Will and Testament?

Copyright: stuartburf / 123RF Stock Photo

What is a Will?

The most basic definition is that a Last Will and Testament is a legal declaration by which a person, the testator, names one or more persons to manage his or her estate and provides for the distribution of his or her property at death.

There are three key elements to a simple Will.

- It names the person, people or company that has the responsibility to carry out the instructions in the Will.

- It describes the distribution of the assets in the “estate”

- It can include the naming of guardians for any minor children

This is why many people believe that you can write your own Will using a blank piece of paper. You would simply state at the top of the page that it is “the last Will of me, John Doe, of Dallas, Texas”. You would then name a person to be your Executor. Finally you would describe how you would want your possessions to be distributed. Technically, this would be a legal Last Will and Testament.

The evidence of this is from the famous case of George Harris, the farmer in Canada who was pinned under a tractor. He suspected that he wouldn’t survive so using a pocket knife, Harris inscribed on the tractor’s fender the words: “In case I die in this mess, I leave all to the wife.”.

The side of the tractor was accepted by the probate courts as a legal Last Will and Testament. This “document” is currently on display at the University of Saskatchewan’s College of Law.

The problem is, this is not a very good Will. It’s a little too simple.

Even a simple Will, when well drafted, would need to include some provision for alternate scenarios. For example, what would happen if the first choice Executor was unable to serve? Most importantly, it would need to include a plan for when the first choice beneficiary were to predecease you, or be involved in a common accident. How would all of your possessions then be distributed?

You may want to include a charitable bequest as well as recognizing the people who have made an meaningful impact on your life.

If there are any minor children named as beneficiaries, then you would want to name a guardian, but also set up a trust for the minors. This includes not only deciding on an appropriate age for them to receive their inheritance, but also naming a person to take care of the trust while they are growing up.

The trust clauses in the Will would include specifying the circumstances under which the funds in the trust can be used while the children are still minors. For example, would it be appropriate for the trust fund to be used to support education and healthcare needs? This is not advanced estate planning. You would expect to see this even in a simple Will.

A well drafted Last Will and Testament would also include a series of clauses that explain the powers being granted to the Executor in order to administer the estate. For example, what are they supposed to do with the assets as they are being gathered? are they able to sell individual items in order to fulfill your distribution plans? are they able to hire professional help to support them in the task? will they be receiving compensation for taking on the role of Executor.

A document created at USLegalWills.com would be considered a “simple Will” but it still runs for about 6 pages, and includes about 25 clauses.

So what is a Simple Will?

At USLegalWills.com we don’t believe that you can go much simpler than our documents and have a well drafted Will. Our key clauses include;

Revocation clause

Identification of family

Executors

Payment of Debts and Taxes

Distribution of property after Debts and Taxes (including bequests to charities and alternate distribution plans)

Trusts for minor beneficiaries

Powers to the Executor

Settlement of claims

Exculpatory Provision

Guardians for children

Non-contestability of bequests

A blank form do-it-yourself simple Will kit usually doesn’t include a complete set of clauses, and can result in critical errors.

What is a complicated Will?

It is actually quite surprising what sophisticated software is able to do. One of the first criticisms aimed at write-your-own Will services is that they do not take into account State specific laws. This may have been true in 1985, but since USLegalWills.com launched our Will writing service in 2001, we have always provided State specific documents, and update our service on a State-by-State basis when laws change.

We have recently introduced support for blended families that allow you to create a life interest in an estate if your spouse is not the parent of your children. It is an important feature and one that was considered beyond do-it-yourself online Will services. But as software becomes more sophisticated, so do our services.

We also have an Expat Will service that would allow you to create complementary Wills for property held in Canada or the UK, to work together with your Will written for US law.

So where are the limits of our services? when would your Will no longer be a simple Will? When would you need legal advice?

There are certainly circumstances where we wouldn’t recommend using our service. If you are planning to disinherit a spouse or a dependent for example. If you had a child with special needs. You would need to seek legal advice. Also if you needed custom trusts set up where you need to determine exactly who has access to the estate and under what special circumstances. Custom drafting of legal clauses demand an experienced attorney.

There are also estate planning tools and techniques to minimize taxes and probate fees, but these techniques should be used together with preparing a simple Will. Even if you have a living trust, you still need a Will. You are simply passing parts of your estate to your trust to reduce the size of the estate. Taxes and probate fees are based on the size of the estate, so by reducing the value, you lower the amount going to Uncle Sam.

But don’t let the optimization phase of your estate planning deter you from preparing your simple Will. Put the Will in place, and then look to fine tune the structure of your estate.

The three approaches to preparing a Simple Will

1. Write your own or use a blank form kit

It is not uncommon for people to offer advice on preparing your own Will. A quick look on eHow.com reveals a dozen or so people offering tips. Unfortunately, none of them have any qualifications and the advice is woefully inadequate. There really should be a law against this!

The next step up from trying to prepare your Will starting with a blank piece of paper, is the use of a fill in the blanks do-it-yourself Will “kit”.

This particular simple will kit uses olde worlde font at the top and uses expressions like “bequeath unto” to give it an authentic vibe. Often, these are free, and downloadable from the internet. Usually they are terrible and result in an extremely poorly drafted Will with no alternate provisions, trusts or guardianship clauses. Most importantly, they are not State specific and so may not even cover the basic legal requirements of your State.

2. Use the services of an estate planning attorney

This is the expensive and inconvenient approach to Will writing, but you are probably going to receive a well-drafted Will. Estate planning attorneys can charge anything from $800 – $1200 for preparing a complete estate plan. Many will claim this is value for money because of their knowledge of tax avoidance strategies, but there are two issues with this. Firstly, the federal estate tax threshold is now set at $5.4 Million, so if your estate is worth less than this, then there are no federal taxes to pay. Some states do have estate taxes, but they may not be as significant as you are led to believe.

In addition, the management of your estate is an ongoing service, not necessarily tied to the writing of your Will. So in most cases, estate planning may not even be included in the $800 Will writing fee.

If you need custom legal clauses to be drafted, then you need an estate planning attorney. But most people do not.

Also, be mindful of some estate planning lawyers writing themselves in as Executor of your estate. This is where the big money is to be made. The Will writing may be offered as a free service if the attorney can generate fees from managing the estate. There are countless examples of estate attorneys acting unethically when administering an estate.

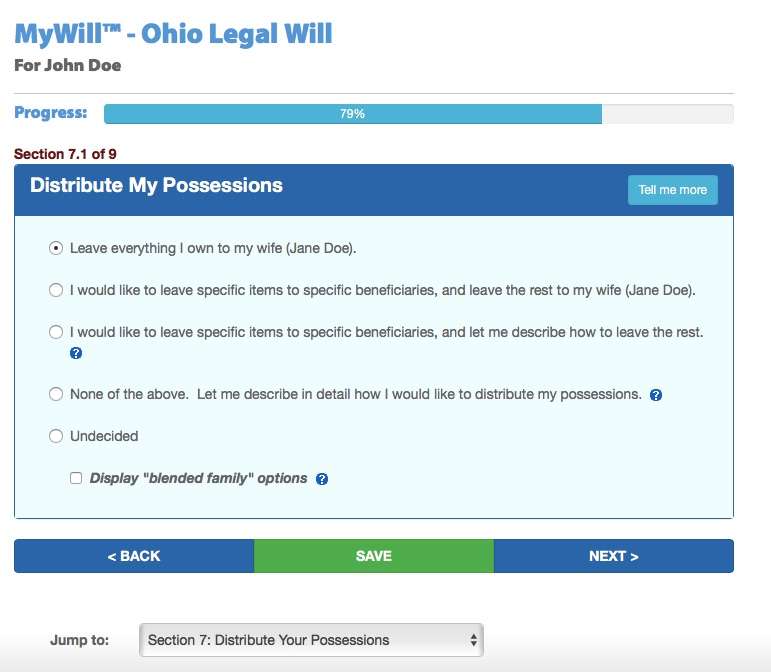

3. Use an online interactive services like the one at USLegalWills.com

Many people feel that this is the best of both worlds. You can prepare your simple Will yourself, but end up with the same document, word-for-word as a Will prepared by an estate planning attorney. We know, because we use the same software as they do, but we just give you direct access to it. If you can file your taxes, you can prepare your own Will.

You step through a series of simple questions then download and print your Will at the end.

There are a number of obvious advantages to this approach; not least is its affordability and convenience. Not only can you create your simple Will in about 20 minutes from your sofa, you can login at any time and make updates to reflect changing personal or financial situations.

The service also takes advantage of the power of the Internet by allowing you to create a “Lifelocker” that will help your Executor track down your assets when they need to administer your estate. It really is the ultimate Executor tool.

What do I get for “free”?

There are 3 ways to provide a free Will service.

1. You can create a blank downloadable form, have no legal or support staff with no costs.

This is a common approach. The service is free, but the Will is just a Microsoft Word document which is barely passable as a Will. It does not check for errors nor does it cover alternate plans, trusts, powers to the Executor and all of the key elements required of a well drafted Will. The document could have been put together by a couple of twelve year olds, and you would be none-the-wiser.

2. You can sell customer data

We are seeing higher quality services emerging that charge nothing for the creation of Wills. But they have costs; legal teams, customer support, website support. In the small print they explain that their business is built on developing partnerships with financial advisors, funeral homes and insurance agents. When you create your Will, you are sharing sensitive information. You may not be comfortable with having no control over where that information is shared. It is not uncommon for people to use these services only to be on a “call list” and have to field incessant calls from life insurances companies and financial advisors.

If a company is offering a quality online Will creation service, they have costs; support, development, and legal costs. If they charge you nothing, they have to cover their costs in a different way, and this is by partnerships going on behind the scenes.

At USLegalWills.com we cover our costs with our up-front fee of $39.95. We do not sell, trade or exchange any customer data in any way with any other company whatsoever.

3. You can take the customer’s credit card details and charge them if they don’t cancel

The most pernicious approach that is based on a deception. If the service is free, then why do they need a credit card? The business model is built on a certain percentage of people not remembering to cancel their “subscription” that can run into an expensive monthly fee. Even if you think you may be able to cancel the subscription, it may not be as easy as you think. You can agree to cancel with the company and whoops…the fee appears next month. You can spend hours trying to negotiate out of these plans.

At USLegalWills.com we provide a quality services and update our legal services on a regular basis. This incurs development and legal costs. We also pride ourselves on our support team who are based in North America and respond very quickly to customer questions by phone and email.

We have never, ever, shared any data with any third party. We do not try and earn our money through deception. The Will service costs $39.95. This is why we have to charge for our service. We simply cannot offer this service for free.

What do I get for a thousand dollars?

Assuming you can find the time and money to pay for an estate planning lawyer, you will probably receive a well-drafted Will. They may even provide you with a Power of Attorney and Living Will. But you are really paying for legal advice.

The irony is that many people don’t need legal advice and so are paying an expensive professional for services that they don’t need. Most of our customers tell us that they only need a simple Will.

If something happens to me, I want everything to go to my spouse. If something happens to both of us at the same time, then it will all be divided equally between our children.

In this situation, the document that you receive for a thousand dollars will be identical, word-for-word the same as one prepared at USLegalWills.com.

We often hear from people who use our service because they need a simple Will in a hurry. They are leaving on a trip the next day, or going into surgery. They tell us that they will prepare a simple Will with us, and then write a “proper” Will with an attorney when they return.

These people are invariably shocked when they finally get their thousand dollar document prepared, and see that it is verbatim the same as their temporary document.

What do I get for $39.95?

Using the Will writing service at USLegalWills.com you have access to an up-to-date service that takes into account State specific laws. You can prepare a “simple Will” from the comfort of your own home and make unlimited updates for a year. You can then optionally choose whether to maintain an update facility beyond the first year, but we don’t keep credit card details on file and cannot automatically charge you anything.

You are able to create a well-drafted document that goes well beyond a simple Will. You can include trusts for minors, lifetime trusts for blended families, and also take advantage of our Executor tool; LifeLocker together with our proprietary keyholder™ mechanism.

If you get stuck, you can email us at any time and we will respond within an hour. Or you can call us at 1888 660 9455 at any time to have somebody help you step through the service. We also have extensive help on every page of the service. Once you have stepped through our service you will not only have created your Will, but you will have educated yourself in the Will writing process.

So don’t delay, get started on your Will today, and don’t forget, we have a 30 day, no questions asked, complete refund policy.

- Testamentary Trusts – what are they and how are they created? - May 9, 2024

- Every document you need for a complete estate plan. - October 29, 2020

- Estate Planning in troubled times - April 3, 2020