“A note on Privacy: the protection and security of the documents created on our web site are of critical importance. In particular, we cannot access any information contained in a specific Will, nor can we read a person’s Will. However, we are able to access aggregated data on planned giving from an encrypted database folder that summarizes the number of times particular choices have been made within our service. We cannot connect this information to individual accounts. It is this data that has been mined to provide the information in this post”

Background to our study

At USlegalWills.com, we help thousands of Americans create their Last Will and Testament. A Will contains a lot of important information, such as who will be the guardians of your children and who will receive your house after you pass on, and it can also serve as a great way to give back to the community upon your death. Leaving money or assets to a charity is called “planned giving,” which USlegalWills.com offers for all its Wills. According to the National Center for Charitable Statistics, in 2015, individual giving, which makes up the vast majority of contributions received by non-profit organizations, “amounted to $258.51 billion in 2014, an increase of 7.1 percent in current dollars from 2013.” Ever since the Great Recession in 2008, “individual giving has been increasing in both current and inflation-adjusted dollars for the last couple years, although it has not recovered to pre-recession levels.”

With this charitable giving trend on the rise, we were interested in the level of “planned giving” going on in the United States. According to Russell James, the number of people aged 55+ with a charitable estate beneficiary hovers between 5% an 6%.

So, although there are professional member organizations dedicated to promoting planned giving, and thousands of people working in the sector, it seems that around 95% of Americans are not including charitable bequests in their Wills.

Clearly, this statistic is a little misleading because we know that around half of those people don’t even have a Will, and the charitable estate plans are only likely to be created by people with a Will in place;no Will means no planned giving.

[tweetthis]Dying without a Will means no planned giving to charities[/tweetthis]At the beginning of 2014, we heard of a study from the UK that suggested appropriate prompting at the time of writing a Will could increase the level of planned giving threefold, and double the average size of charitable bequest.

The missed opportunity

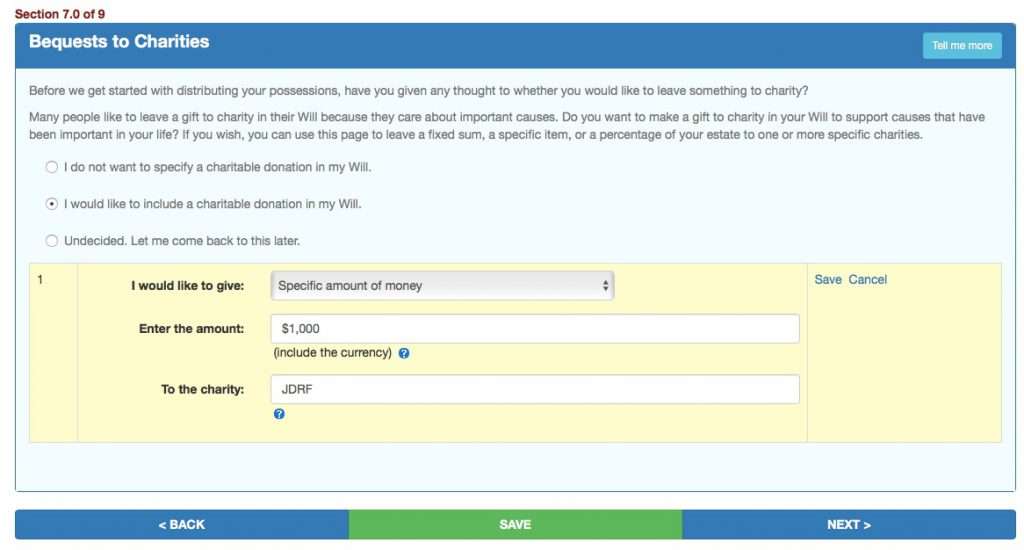

After hearing about this study, we realized that at USLegalWills.com we had missed an opportunity to promote charitable giving within our service and immediately implemented a charitable bequest page that all users of the service would see when preparing their Will. It’s something that we would like to see all Will writing services implement, but so far, we are the only service that does this.

The inclusion of this page also allowed us to run some statistics on planned giving within the United States.

The data source

Customer and business confidentiality precludes us from providing specific detail on charitable bequests but we are able to provide some generic reports that offer some valuable insight into the state of planned giving in the United State. These statistics were pulled from the last year and are drawn from over 10,000 Wills created through our service.

These are real Wills, created by real Americans. These are not survey results, or information gleaned from questionnaires. Clearly Wills can be updated throughout one’s lifetime, so there is a chance that bequests will be added or removed from these Wills. These statistics therefore provide a snapshot.

It is also worth noting that we offer an affordable estate planning service, so it is possible that very high net worth individuals would not be using our service. Having said that, there were bequests of $250,000 in some Wills created using our service. We know that although we do not necessarily service the top 1 percenters, the remaining 99 percent are open to using our service.

A study of probate records in Australia showed that when they compared self written Wills, Wills prepared through a kit, online software or Wills prepared by a legal professional

Analysis indicated that there is no statistical relationship between the form in which a will is prepared and the likelihood of including a charitable bequest.

In other words, the level of planned giving was not statistically different whether the Will was prepared using an online Will service like ours, compared to having a Will prepared with a lawyer.

Why Give a Charitable Bequest?

Planned giving is something that many people would like to do, but many people do not have the funds to do in any substantial amount. Even if a person is well off financially, there is always a worry that they or their family will fall on hard times and will need some extra money, so often people hesitate to make large charitable donations. By donating to charity in the form of a charitable bequest in a Will, it alleviates this risk, since upon the death of the donor, the funds would no longer be needed by him or her. This makes it easier to donate to charity in larger amounts than one would be able to while still living.

Charitable bequests are also simple and easy. They can be written into a Will with a short paragraph, but can also be revocable in that a subsequent Will or codicil can cancel a bequest. This is attractive to some donors, since if they fall on hard times or their family falls on hard times, they are able to retract the charitable bequest.

Even though a charitable bequest written into a Will is only donated after the death of the donor, it can still be a very rewarding gift in that the donor is comforted by the fact that after they pass on, their estate will be doing some good.

Some Key Demographics

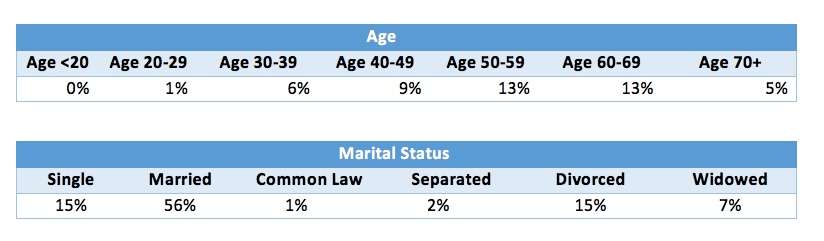

In terms of age, users of our service are split nearly 50:50, with 44% of users being men and 56% being women. Other key demographics include age and marital status, which are listed below:

Aggregate Charitable Gifts

In 2015-16, 7.2% of users included a charitable bequest in their Will.

Most charitable bequests are made to familiar organizations, such as franchise community charities like the Salvation Army, or to the user’s local church.

When a customer fills out a charitable bequest form as they are drafting their Will with USLegalWills.com, the prompt is only for making a charitable bequest in general as opposed to promoting specific charities to donate to. LegalWills is more than happy to collaborate with charities to include their name in a prompt that asks for a charitable bequest, but the demand for this service has not been high. Thus, customers need to enter in the charity information themselves if they wish to leave a bequest, as opposed to simply clicking on a prompt. This could be a factor in greatly reducing the number of charitable bequests that are given out in Wills, since people are more likely to do something if it is easy.

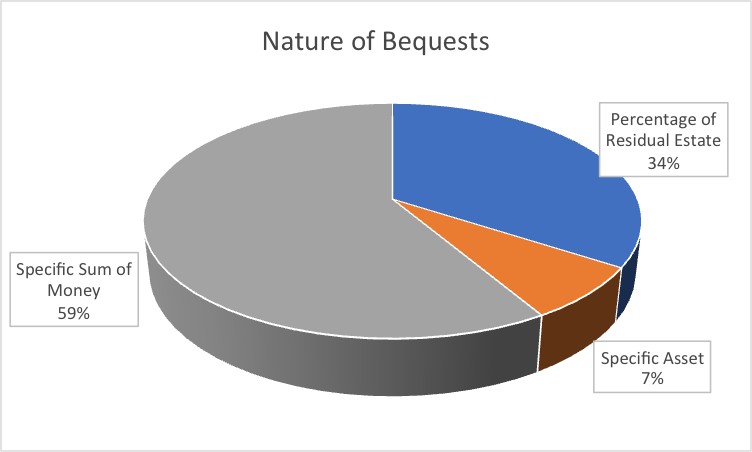

Of all the bequests, 59% were specific sums of money, 34% were percentages of the person’s residual estate and only 7% were a specific asset, such as a painting collection, contents of their house or a car.

Classifications of Planned Giving

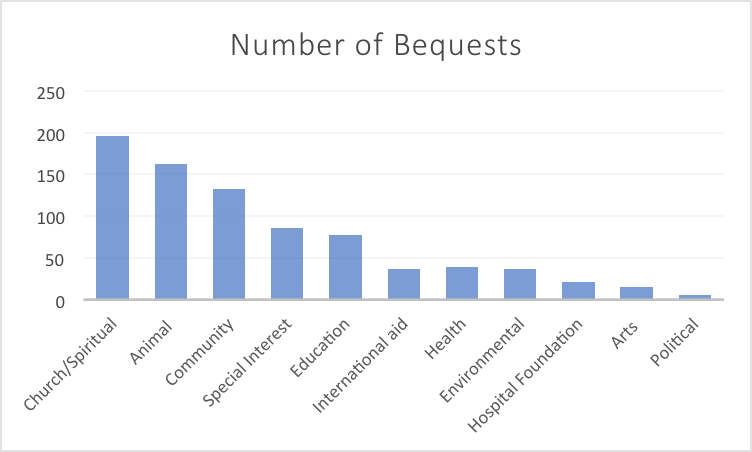

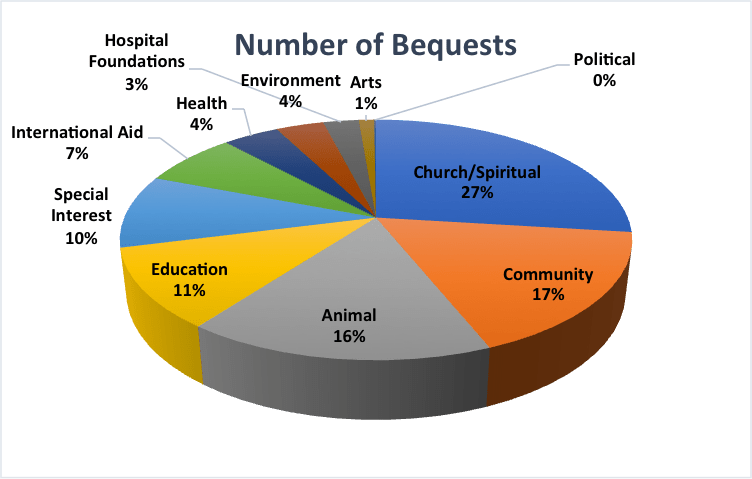

We struggled to find an industry standard classification for charitable sectors, so we divided the bequests into logical sectors including:

Animal – this is a broad category that includes animal rescue, zoos, humane societies and other wildlife organizations, like the World Wildlife Fund.

Church/spiritual – included all religious denominations from specific churches to religious leaders.

Health – we separated this from hospital foundations, but it includes charities focused on individual conditions e.g. cancer, Juvenile diabetes, AIDS, Heart and Stroke, Alzheimers etc

Hospital foundations – a self explanatory group including any hospital but excludes general health charities listed in the category above. There was some debate about collapsing this with the health sector, but we decided to keep them separate, because it is a popular target for charitable donations.

Community – this included any charities working to improve the places where we live e.g. feeding the hungry, missions, shelters, girls and boys clubs, and we also included United Way, Salvation Army and the Lions clubs in this sector. These include faith based charities with mandates to improve society, but distinct from the church/spiritual category that include bequests to benefit the actual organization.

Environment – This included conservation charities in this category if they were not animal related e.g. Greenpeace, Nature Conservancy.

International Aid – this is a general grouping of charitable bequests that are likely to be diverted overseas e.g. World Vision, Oxfam, Doctors without Borders, Amnesty International etc

Arts – included any art galleries, museums, choirs or other musical organizations

Education – this includes all universities, schools and colleges

Special Interest – We included this category to capture donations to small professional bodies, memorial funds, clubs, societies and hobby groups.

Politics – we decided that political parties didn’t really fit into any of the categories, and so bequests to political parties and other political organizations have their own category.

Although some organizations blurred the lines between categories e.g. a church based charity focusing on worldwide heath issues, we counted each bequest only once, and so each bequest can only appear in one category. Charities like Planned Parenthood could be regarded as a community, special interest, or political target.

As demonstrated by the graph above, church/spiritual charities are the most popular beneficiaries of planned giving, followed by animal-related charities. Arts and political organizations receive the smallest number of bequests. This does make sense, since spiritual- and animal-related causes are appealing for a wide number of people, whereas organizations related to arts an politics are a bit more niche.

Value of Bequests

USLegalWills.com offers three kinds of charitable bequests: specific dollar amounts, percentages of residual estates, and specific assets. Specific assets can be anything from a car to a stamp collection to a painting.

Again, the study of probate records in Australia reported that:

Charitable bequests made as a specified $ value gift were on average significantly lower in value than those made as a residual of the estate:

- $7,000 median value of specified charitable bequests

- $200,000 median value of residual bequests.

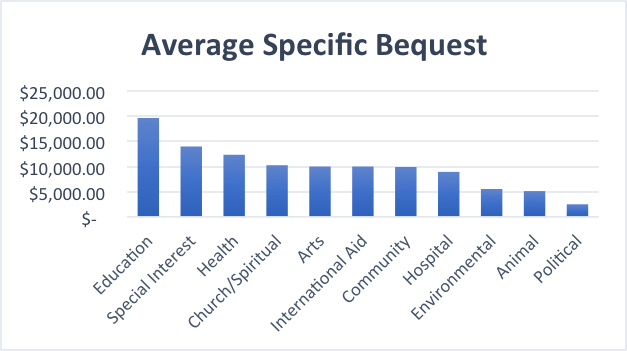

For this report, we separated the specific sums to see the average size of a monetary legacy to each charitable sector.

The total mean average charitable bequest given as a specific sum of money is $9389, with the following breakdown:

The category with the highest average donation is education, with an average of nearly $20,000. This does not surprise us, since it is common practice for alumni to donate to their post-secondary institution or former school, especially in higher amounts for those individuals who make a significant income.

Size of bequest vs frequency

Though bequests for animal-related charities is one of the most popular categories, the overall average for the amount donated to that sector is just over $5000. This is still quite high, but most of the bequests to animal-related charities tend to be on the lower end of the spectrum. The church/spiritual category also boasts a high number of bequests, but unlike animal charities, receives a significant amount of money per person, with an average of just over $10,000.

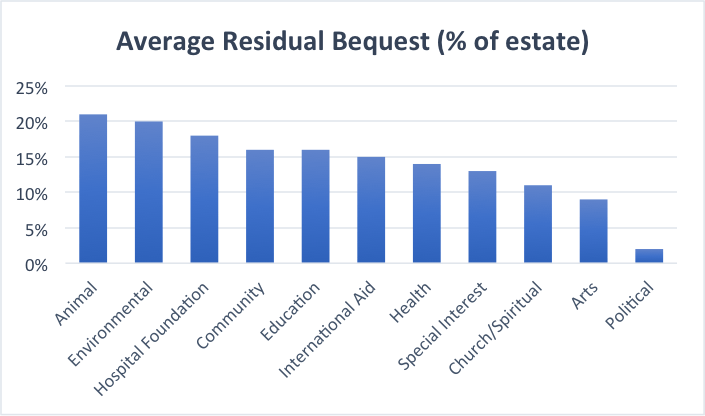

Percentage of estates can also be a significant amount of cash. An estimated figure for the average size of a residual estate, aggregating data from Statistics Canada and life expectancy information and then taking into account the difference in the US and Canadian dollar, hovers around $340,000. Even just 10% of this data is $34,000, which is a very significant sum. The average percentage of residual estate left for planned giving across all categories is about 14%, which is $47,600.

[tweetthis]Leaving just one percent of your estate to charity can make a big difference[/tweetthis]When broken down by category, animal charities lead the group with an average charitable bequest of 21% of the residual estate. This is followed shortly after by environmental charities, who get on average 20% of an individual’s residual estate, while hospital foundations earn about 18%. The categories with the lowest-percentage residual estate donations are arts, with an average of 9%, and political, with an average of 2%.

Monetary legacies vs percentages of estate

Interestingly, animal, environmental, community and hospital foundation charities were all in the bottom half of the spectrum when it came to donations of specific amounts of cash, but they are all in the top half of the spectrum when it comes to percentage of residual estate donated. This could potentially be because individuals who wish to leave bequests to these charities have a lower income, so though they donate a good portion of their residual estate, it is not a very large cash amount compared to, say, those that donate only a few percent of their residual estate to a university or college. Those individuals normally have a higher net worth, being post-secondary grads, and thus a smaller percentage of their estate is actually a higher cash amount.

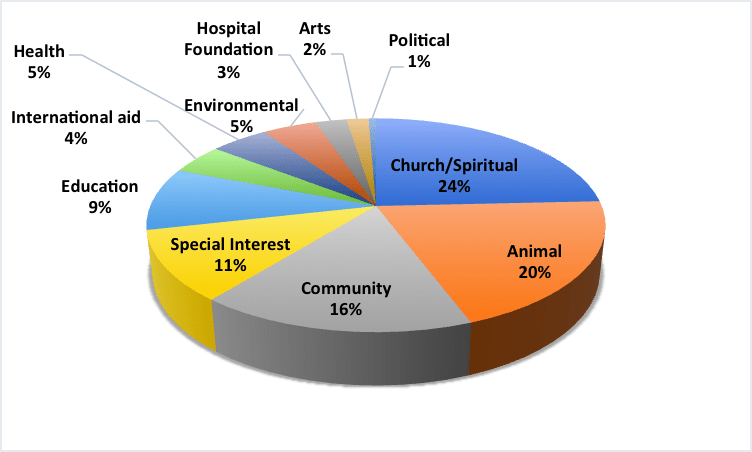

Total Distribution Across Charitable Sectors

In order to give an accurate representation of the monetary value of all charitable bequests, we calculated the approximate values of all residual estates by using the $340,000 figure mentioned earlier. We then evaluated all specific assets to come up with an approximate cash value for each. If this were an academic paper as opposed to a blog post, we would probably be more rigorous in the research approach, but these figures work to illustrate what categories command the majority of the market for charitable bequests.

Church/spiritual bequests are the most popular, taking up 27% of the total cash amount given out in charitable bequests. The community and animal categories follow closely behind at 17% and 16%, respectively. Arts and political organizations come in at the bottom with 1% and next to no percentage. This is fairly consistent with the rest of the data that has already been presented.

When compared to the data on the distribution of the number of bequests per category, the percentages are similar. The only notable differences are by a matter of 3-4% in the cases of the church/spiritual category, where the distribution of the number of bequests is 3% higher than the distribution of the monetary value of those requests. Also within the animal category, whose distribution of the number of bequests is 4% lower than the distribution of the monetary values of those requests.

Overall, planned giving is an important part of any Will and can be a nice way to give back to the community once a person has passed away. Though death is an unpleasant subject to think about, the unpleasantness can be lessened by knowing that a portion of a person’s estate is working for the greater good.

Please get in touch

If you have any comments on this study, or are interested in seeing more data on planned giving within our online Will service, please comment below.

If you are a charity and interested in partnering with us at USLegalWills.com please contact us at [email protected] . We would be very happy to work with you. Maybe together we can improve the level of planned giving in the United States.

- Testamentary Trusts – what are they and how are they created? - May 9, 2024

- Every document you need for a complete estate plan. - October 29, 2020

- Estate Planning in troubled times - April 3, 2020