The lifestyles of the rich and famous are endlessly fascinating. Sometimes they become even more fascinating when they are no longer with us. You would think that the privileged among us would have it all sorted out when it comes to estate planning and wills. However, as you will see from these notorious cases, all too often they make huge errors. Here are some stories of the most complicated and prolonged disputes over wills and estates.

Anna Nicole Smith

The ill-fated and rather tragic life of Anna Nicole Smith involves not just one, but two estate disputes. Anna Nicole married J. Howard Marshall in 1994 when he was 89 years old. Anna Nicole, a former Playboy Playmate was just 26 at the time of their marriage. Some saw the 62-year age gap between the couple as an excuse to label the bride a gold digger – you can of course draw your own conclusions!

- Howard Marshall had a considerable fortune of $1.6 billion. He had made his considerable fortune in the oil business. Anna Nicole always said that she married for love and was shocked when he died and left the bulk of his fortune to his son E. Pierce Marshall. The bride of just 14 months claimed that her husband had promised to leave her half of his fortune. Unfortunately, he had neglected to make a new will and she was not even mentioned.

One of the most infamous court battles over an estate began. It was a battle that would last 20 years and have many twists and turns along the way. It is possible that it isn’t even finished yet.

To describe the court battle as complicated is a serious understatement. Anna Nicole challenged the will in Texas. She wasn’t alone in her challenge. J Howard Marshall’s other son, confusingly called J. Howard Marshall III also challenged the will.

The case had its first twist when Anna Nicole filed for bankruptcy in California. Pierce somewhat foolishly decided to sue her for defamation in the California bankruptcy court. Not a wise move as this gave Anna Nicole the chance to counter sue. Her argument was that Pierce tricked her devoted husband into not including her in his will.

Pierce was defeated by Anna Nicole in the California court and she was awarded $475 million. However, this was only the beginning. Anna Nicole tried to get the Texas probate case dismissed, but failed. The Texas court decided in favor of Pierce and against Anna Nicole and Howard III.

However, things were really only just getting started at this point. The case has been heard not once, but twice, by the Supreme Court. The highest court in the land decided in favor of Pierce Marshall and against Anna Nicole. By the time of the second ruling both Anna Nicole and Pierce were deceased.

The battle had yet another twist. It just goes to show how to keep the lawyers happy by filing in two different jurisdictions in two different states. The California federal court once again issued a ruling in favor of Anna Nicole in 2013.

The final chapter of the case was written in 2015 by the Texas appellate court. Well, probably the final chapter, although some argue that there is still a way to keep litigating. The latest ruling in July 2015 reversed a previous decision that Anna Nicole’s estate should pay sanctions to Pierce Marshall’s estate.

The case lasted 20 years and there is still the possibility that it may not be over. Pierce Marshall die in June 2006. Anna Nicole died of an accidental drugs overdose in February 2007. She was only 39 years old.

The final twist of irony was that Anna Nicole left her entire estate to her son, who had predeceased her in September 2006. When she died, she had a five-month-old daughter Dannielynn. Her will was not changed to mention her daughter. It seems that even if you have had a law suit worth hundreds of millions of dollars this doesn’t always mean you will make sure that your own estate planning is in order.

A custody battle immediately followed her death with four men claiming to be Dannielynn’s father. Paternity tests found that the father was Larry Birkhead. Dannielynn is now the sole heir to Anna Nicole’s estate. If the case is ever reopened and decided in favor of Anna Nicole it is Dannielynn who would inherit the fortune.

Robin Williams

The will of the actor Robin Williams became the subject of a legal dispute between his wife and his three children. Robin Williams left all his $100 million estate to his adult children Zachary, Zelda and Cody. There was an additional provision in the will that his wife Susan Schneider Williams should live in the house they shared in Tiburon. The will stated that she should live in it for her lifetime, but that the children will eventually inherit that as well.

Williams had recently updated his will prior to taking his own life in August 2014. No doubt he had wanted to make it clear as to his exact wishes of the distribution of his assets should be. However, unfortunately as sometimes happens, family members disputed how the estate should be allocated. He had specified in his will the large items such as the house and the money. However, it appears that there was some ambiguity over who kept the items in the house where he lived with his wife.

There followed a bitter and no doubt expensive, legal dispute over the distribution of his estate. The dispute was over who was entitled to keep personal items. His widow and his children each wanted to keep sentimental items such as his clothes, his fossil and graphics novels collection and personal photographs. His widow claimed that all the personal items in the home should not be included in the items willed to his children. This was the crux of the matter to be decided before the courts. His widow argued that by expressing the wish that she lived in the house, her husband had implied that the contents would also be hers. The children argued that the will was clear in his intent to give his personal possessions solely to them.

The parties managed to settle their dispute out of court in October 2015. The terms of the settlement were not made public, but it is known that his widow will remain in the home. There is a trust set up for the expenses of the maintenance of the property. Susan Schneider Williams also received some personal items such as a watch, and their wedding gifts.

This unfortunate dispute shows that you need to be as clear as possible in the terms of your will. Unfortunately, though where families are involved there can never be a guarantee that someone won’t challenge the terms of your will. However, a well drafted will is always difficult to challenge so should deter people from trying to make it the subject of a dispute.

Prince

The legal battles have only just begun in the estate of the beloved artist known as Prince. He may have been a musical genius, but he seems to have made a serious error. It appears that he did not leave a will.

It isn’t yet known just how much the estate is worth, but estimates put it at around $500 million. When so much money is at stake you can be sure that the legal battles are going to be going on for some time. The value of his estate is set to increase over time. Just as Michael Jackson’s estate made hundreds of millions after his death, it is thought that Prince’ estate will increase substantially.

As Prince died intestate it must be established who the blood relatives are which have a claim upon his estate. This of course is a great opportunity for people to come forward claiming to be the long-lost son/daughter/aunt/whoever.

Shortly following his death dozens of people claimed to be a blood relative. Thankfully we have DNA testing these days, so the ones with false claims could immediately be dismissed. However, there remain several possible heirs. A judge has ruled that his full sister and five half siblings qualify as his heirs.

However, the story doesn’t end here. Far from it. It appears the Minnesota courts are going to be hearing this case for some time into the future. The current question before the court is the legal definition of “father”. You really would think this should be a straight forward question, but in this legal battle the answer hasn’t yet been determined. As well as the six recognized blood relatives, there are two additional potential claimants. There are the daughter and granddaughter of Duane J. Nelson. The litigants claim that Duane J. Nelson was Prince’s “brother”.

You would think this concept was easy. A brother is someone with whom you share at least one genetic parent. It seems things are not that straight forward. What if you called someone your son, were named on the birth certificate as the father, but weren’t genetically related? What if you always referred to each other as father and son, but never lived together or financially supported them? Clearly this is going to keep the lawyers busy for some time. With $500 million at stake it seems to be worth asking the court to determine. The case will potentially last for many years.

The money is not the only problem. With no will in place there is no provision for who will control his music, brand, image and legacy. For most people in the world this would not be much of a problem, but for an internationally known mega star like Price, this is a huge issue.

We can look to the case of another hugely popular musician to see just how complicated an issue this can be. Jimi Hendrix died without a will. As he died intestate in New York everything passed to his father. The problem came when his father died many years later. Ultimately the control of his legacy went to his adopted half-sister. Jimi only met her a couple of times, but now she has control of his image and legacy. We can only speculate, but this surely is not an outcome he would have wished for.

The dispute over Prince’s estate is only just beginning. The moral of the story? Make a will.

Howard Hughes

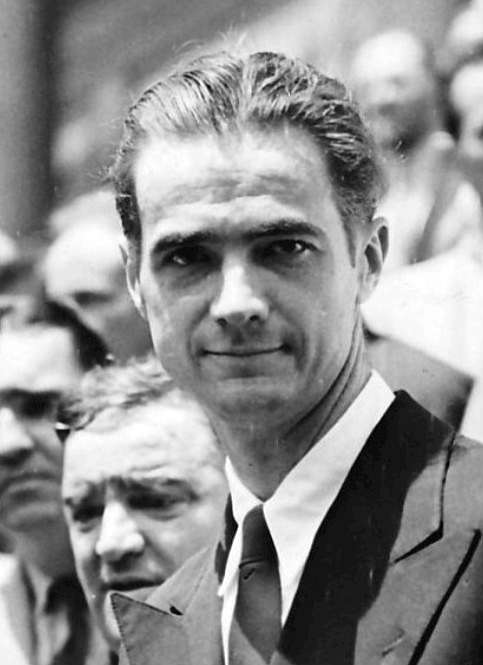

It is a predictable scenario. A billionaire dies leaving no will and no living relatives. Suddenly people start coming out of the shadows and claiming to be long lost wives, children or beneficiaries of the deceased. In life, Howard Hughes was a fascinating character. In death, the lengthy process to distribute his wealth is equally compelling. It took more than 20 years to resolve the issue of his estate.

Howard Hughes died in 1976. He had inherited $1 million when he was 18 from his parents, who ran a very successful oil tool business. Hughes built up his empire in oil, movies and numerous other business interests to earn the title of the richest man in the world. In later life, he became a recluse.

One of the most interesting claims to the Howard Hughes fortune was by Melvin Dummar. His story reads like something out of a movie, but some believe it could be true. He says that he was driving though the Nevada desert in December 1968 and stopped to answer a call of nature. He saw a man who he thought was homeless, took pity on him and drove him to Las Vegas. The dishelved man claimed to be Howard Hughes.

When Hughes died in 1976 the search for his will began. Miraculously one was found at the headquarters of The Church of Jesus Christ of the Later-day Saints in Salt Lake City. The document purported to be Hughes will. The document divided his estate into 16 equal shares. One share went to the Church and another went to Melvin Dummar. Not surprisingly this will was not thought to be genuine. Howard Hughes cousins were his closest known relatives so immediately challenged the validity of the will. The story was seen as way too fanciful and was dismissed as a hoax.

The distribution of the estate would probably have been much easier and quicker if the will had been found to be valid. Initially the huge estate was divided amongst his aunts, uncles and cousins. However, the number of claims on the estate has since risen to more than 1,000. The estate has so far been calculated to be worth more than $1.5 billion. It took years to distribute as land and assets were still held in the Hughes estate. To describe the distribution of the estate as complicated is a vast understatement.

Leona Helmsley

The name Leona Helmsley may not be as familiar to you as all the other famous people here, but we really had to include this outrageous story. Anyone who has a pet will know that often they are treated as a member of the family. However, not many of us would think of leaving more to our dog in our will than our relatives. Not so the controversial Leona Helmsley.

In life, she was a difficult person to get along with. Her most famous quote was “We don’t pay taxes. Only the little people pay taxes.” Unfortunately for her the IRS did not agree with that sentiment. She served 19 months of a 16 years’ prison sentence for tax evasion.

She was a controversial and unpopular figure. It is no surprise that she was nicknamed the “Queen of Mean”. Her son died of a heart attack and Helmsley wasted no time in evicting his widow from a property that she owned. She also successfully sued his estate for $146,000 she claimed he had borrowed from her.

She had inherited a huge fortune in 1997 upon the death of her husband Harry. His assets included not only the Helmsley hotels, but the Empire State Building. Her inheritance was estimated at $5 billion. When she died in 2007 her estate was said to be worth around $8 billion.

Most of her estate was distributed to the Leona M. and Harry B. Helmsley Charitable Trust. She left instructions that the trust be used to benefit dogs. Unfortunately for Helmsley the instructions were left separately from the trust documents so a court ruled that the trust is not bound by her wishes. It seems that no matter how expensive the legal advice, sometimes errors are made.

Helmsley was survived by her four grandchildren. However, she chose to exclude two of them from the will altogether. The other two received a total of $5 million each on condition that they visit their father’s grave once a year.

However, Helmsley did make a separate bequest to one favorite four-legged friend. The interestingly named “Trouble” was a major beneficiary of her estate. Trouble was her beloved Maltese dog. However, things did not go as planned for Trouble. The grandchildren challenged the will and got the original award of $12 million down to a meagre $2 million. Perhaps not enough to keep the dog in the style they were used to! The excess money was distributed as a total of $4 million to the charitable trust, and the $6 million remainder when to the disinherited grandchildren.

Trouble died in 2010. The dog had some unusual expenses including $100,000 a year on a security detail. Several credible death threats had been issued and protection of the trust fund dog was clearly very important. $8,000 a year was used for grooming, but only a modest $1,200 a year on food. Her caretaker had a salary of $60,000.

It just goes to show that no matter how rich or famous you are, it is important to write a Will. The higher the stakes the more likely that a challenge will be made. The winners? Just think of the legal fees in these cases and you decide.

- Testamentary Trusts – what are they and how are they created? - May 9, 2024

- Every document you need for a complete estate plan. - October 29, 2020

- Estate Planning in troubled times - April 3, 2020