We get this question almost every day; “I would like a will for my husband and I. This is only letting me do one will. How do I get a joint Will that will allow us to give what we have to each other?

Couples have several options when writing a Will together. Among them are:

- A Joint Will;

- Mutual Wills;

- A Reciprocal Will or Mirror Will.

Defining a Joint Will and Mutual Wills

A Joint Will is a single document that allows for a couple to combine their Last Will and Testament. Normally, one partner inherits the entire estate when the other dies. When the second partner dies, the estate will be handled as agreed to by both partners.

Mutual Wills offer couples essentially the same thing. Mutual Wills are generally two identical Wills supported by a separate document that commits the surviving partner to a particular distribution of their estate, in effect, it creates a Joint Will.

In lay terms, a joint Will would say something like

“If either of us dies, the surviving partner would receive everything. When the surviving partner dies, then everything we own would go to the Salvation Army.”

The Catch: Why Joint and Mutual Wills aren’t as convenient as they seem

While this can seem like a reasonable approach, there are several key complications that confuse things.

Firstly, there is no advantage; A joint Will was historically used to save time writing or typing out duplicate content. It used to be a time, and money saver to prepare one Will to serve two people. Now that Wills are generally created on a computer, and printed on a printer, the potential cost- and time-saving benefits of a Joint Will are irrelevant. Ironically, in most cases, joint Wills end up being considerably more expensive than Mirror Wills (which we will get to).

Secondly, the approach is a little anachronistic. Historically, in the era of “Mad Men” and before, we had less of a sense of two people owning their share of an estate. We still occasionally get the question “does my wife need a Will as well? Doesn’t my Will also cover her?”.

Most importantly, a joint Will and Mutual Wills can create many issues. While you or your spouse may be comforted knowing that their Will is unalterable, there is dispute in many jurisdictions as to how binding or irrevocable Joint Wills actually are once the first partner has died (how easy is it to cancel a joint Will?). What happens if the surviving partner moves onto a new relationship, or, in the example above, what happens if the Salvation Army are no longer an appropriate organization to receive your entire estate?

Joint and Mutual Wills: Ambiguous, yet rigid

You won’t have to search very hard for examples of nasty court cases around a Joint Will and Mutual Wills. As to whether or not Joint Wills can really be contractually binding, different States have a different position on the issue. .

Most judges have ruled that it doesn’t really matter what the joint or mutual Will says, your surviving partner can still use your estate however they wish until they die. They can use it as they see fit as long as they are alive; otherwise, parts of the estate could be tied up for years, even decades in the event of early death.

Even if the courts were consistent about the power of a joint Will, it is still a poor approach. If something happens that makes the original Joint Will outdated, it is extremely difficult, if not impossible, for the surviving spouse to make changes.

Defining Reciprocal and Mirror Wills

Reciprocal or Mirror Wills are separate Wills in the individual names of both partners, that describe essentially the same terms. Names aside, they are often identical, but don’t necessarily have to be. Most commonly, Mirror Wills have the surviving partner and children inheriting the estate. While there is no contract or binding agreement in place that prevents the surviving partner from amending their own Will later on, Mirror Wills don’t have the heavy-handed rigidity or the legal ambiguity of Joint or Mutual Wills.

The advantages of the flexible approach

Because of the complications around Joint and Mutual Wills, it is much better for partners to make a mutual moral commitment to respect the spirit of their agreement, rather than make the other legally obligated to do so. No Will, however cleverly constructed, can possibly foresee every contingency, and retaining the flexibility to alter the Will if it becomes appropriate to do so can prove very valuable.

But what about the children?

A common concern arises when you have children from a previous relationship. There is a danger that your entire estate is passed to your current partner. You need to have some way to protect the inheritance of your children. You wouldn’t want your partner to then re-write their Will to leave everything to their own biological children at the expense of your children.

If you want to ensure that a specific beneficiary receives something, rather than writing a joint Will that is binding and irrevocable (cannot be cancelled), a Trust is a great option.

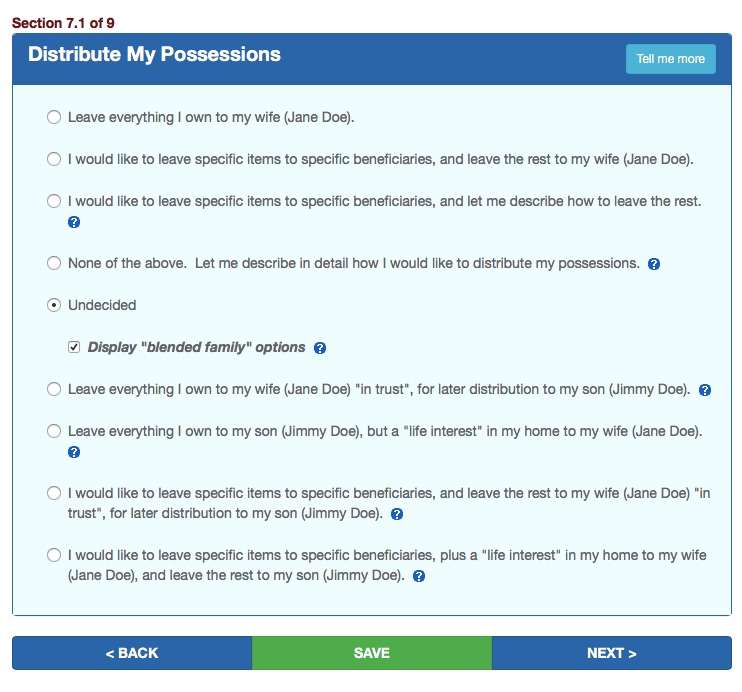

We support this within our Will writing service at USLegalWills.com by allowing you to set up a Lifetime interest in a property (allowing your current partner to live in a house for the rest of their life, at the end of which, it passes to your children). Or a Lifetime estate (allowing your current partner to live off the proceeds of your estate, but it is held in trust for your children).

Mirror Wills: The best option for most people

Most couples would be best-served by Reciprocal or Mirror Wills instead of a Joint Will or Mutual Wills. Given that Mirror Wills are better for virtually everyone, we do not offer Joint or Mutual Wills, especially in light of the commonly reported problems. With USLegalWills.com, writing Mirror Wills appropriate for you and your spouse or partner is both convenient and affordable; We actually offer a 40 percent discount off the second Will, so the first is $39.95, the second is jut $20.97.

We estimate that the first Will should take about half an hour to complete. But once you are familiar with the service, setting up the second Will would probably take half the time.

Of course, if you have any questions, our support team are always here to help.

- Testamentary Trusts – what are they and how are they created? - May 9, 2024

- Every document you need for a complete estate plan. - October 29, 2020

- Estate Planning in troubled times - April 3, 2020