Table of contents

- 1. You tried to list all of your assets

- 2. You included things you didn't own

- 3. You failed to name a residual beneficiary

- 4. You failed to include dependents

- 5. You didn't think through alternate scenarios

- 6. You didn't sign your do it yourself Will correctly

- So, should you steer clear of a do it yourself Will?

Every once in a while a news article appears that describes how a person made a mistake when preparing a “do it yourself Will”. The legal profession often latch onto these articles as a warning for anybody thinking of preparing their own do it yourself Will, suggesting that if the person in the article made a mistake, it follows that you should probably seek legal advice.

Clearly people make mistakes. Even lawyers make mistakes when preparing Wills, like this one who had a couple accidentally sign each other’s Wills. However, it would be disingenuous to use this example as a cautionary tale, and suggest that you should avoid using a lawyer because they always get things wrong.

So I have gathered up some recent news articles, and looked at some of our own support questions and listed the six most common mistakes people make when preparing a do it yourself Will.

Table of Contents

1. You tried to list all of your assets

Never try to distribute your estate based on the assets that you have today. For example, if you have three children and you want them all to share equally in your estate, it is a terrible mistake to start listing your assets in your Will with a view to roughly evaluating each item so that each child gets a fair share.

You are highly unlikely to die today or tomorrow, from which point on this list of assets will probably change. You actually have no idea what your assets will be when the Will comes into effect. It could be tomorrow, or it could be decades into the future. You don’t want to have to update your Will every time you buy or sell an item.

In a do it yourself Will you can of course leave specific items to named beneficiaries. If you have a particular family heirloom or you want to leave a specific sum of money to a charity, you can certainly do this. But once the specific items have been described, your Will then has to speak in general terms; “everything to my spouse”, or “divided equally between my children”.

It will then be up to your Executor to gather your assets at the time of your death and distribute them according to your wishes.

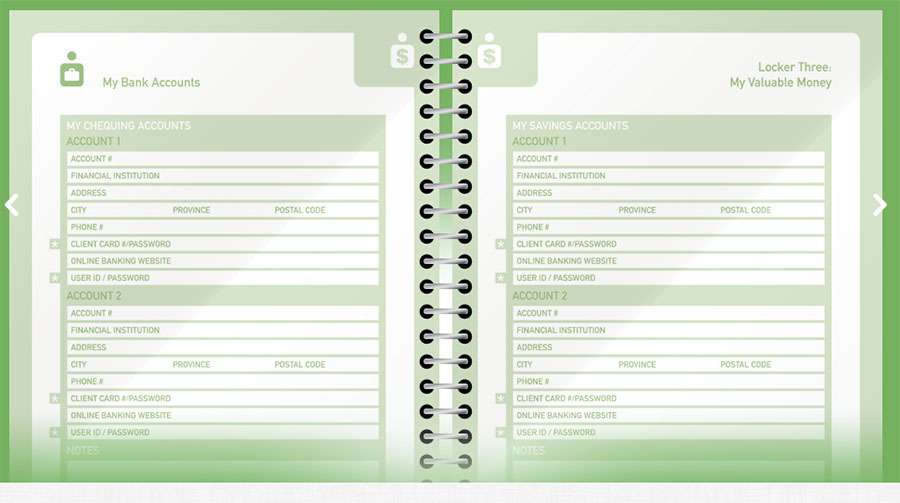

It is a good idea to keep a list of assets documented somewhere to help your Executor with the task of gathering everything. But this list should be stored with the Will, not included in the Will itself. The list of assets can then be annotated and amended as many times as you wish. Or you can use a service like MyLifeLocker at USLegalWills.com to automate this process. The LifeLocker service is the best Executor tool offered by any online Will writing service.

2. You included things you didn’t own

A recent case in the UK highlighted the issue of not really knowing what does and doesn’t belong to you. The most common error is including a house as part of your estate and leaving it to a family member. However, many houses are owned as “joint tenancy with rights to survivorship”. This ownership structure is commonly used between married couples. In this co-ownership, the rights of survivorship mean that upon the death of one owner, the share is transferred automatically to the surviving owner. The survivorship rights take precedence over the deceased’s will or inheritance rules.

In a do it yourself Will, occasionally a parent will leave their share of a house to a child, and then leave the proceeds of a life insurance policy to another child thinking that they have approximately the same value and they have treated each child equally. However, if the house is owned in joint tenancy, this bequest will be ignored, and one child will receive nothing from the Will.

3. You failed to name a residual beneficiary

The residual beneficiary is a vital component of any Will, and without it, the document often doesn’t work. The residual beneficiary receives everything after taxes, funeral expenses, debts and specific gifts are distributed. They also receive everything that cannot go to the intended recipient for whatever reason (often because this recipient has died before the testator – the person writing the Will).

In practice, the residual beneficiary often ends up being the main beneficiary of the estate. It is very common for a do it yourself Will to state that the entire estate, after debts, taxes and funeral expenses have been paid, will go to your spouse. Your spouse is therefore the residual beneficiary and also the main beneficiary of your estate.

This issue was highlighted by the case of Ann Aldrich in Florida who wrote her Will using the do it yourself Will approach but chose a blank form Will kit (not recommended). In Article III, entitled “Bequests,” just after the form’s pre-printed language she hand-wrote that

“after payment of all my just debts, my property be bequeathed in the manner following. All of the following possessions listed go to my sister, Mary Jane Eaton:

—House, contents, lot at 150 SW Garden Street, Keystone Heights FL 32656

—Fidelity Rollover IRA 162–583405 (800–544–6565) —United Defense Life Insurance (800–247–2196) —Automobile Chevy Tracker, 2CNBE 13c916952909

—All bank accounts at M & S Bank 2226448, 264679, 0900020314 (352–473–7275).”

And that was it. There was nothing in the Will to describe what would happen to everything else, and she died five years after the Will was written. This is one of the most commonly cited examples of the dangers of a do it yourself Will.

4. You failed to include dependents

Copyright: ababaka / 123RF Stock Photo

In the U.S. it isn’t easy to disinherit your spouse. But the same is not true for other family members – generally, you can use your Will to disinherit your brothers and sisters, your nieces and nephews, or in some cases, even your very own children and grandchildren.

In most States, you can’t intentionally disinherit your spouse unless your spouse actually agrees to receive nothing from your estate in a separate agreement.

Unfortunately there isn’t one set of rules that govern what a surviving spouse is entitled to inherit. Instead, the laws governing spousal inheritance rights, referred to as “community property laws” or “elective share laws” depending on the state where you live or own property. In some states the surviving spouse’s right to inherit is based on how long the couple was married. In other states the surviving spouse’s right to inherit is based on the value of assets included in the estate of the deceased.

In general, if you are considering disinheriting your spouse or dependents we would recommend not going the do it yourself Will route. In many jurisdictions you can disinherit adult children, but minor children are dependents who cannot be ignored in your Will. You probably need legal advice if you are planning to do this.

5. You didn’t think through alternate scenarios

This is one of the trickiest issues to work through, but it is vital for anybody preparing a do it yourself Will. You have to consider a series of “what-if” scenarios so that no matter what happens, and in what order, you still have a distribution plan for your estate. Take the example of the Estate of Duke in California. In this case Irving Duke took the do it yourself Will route and prepared a holographic will providing that, upon his death, his wife would inherit his estate and that if he and his wife died at the same time, specific charities would inherit his estate. The handwritten will, however, didn’t explain what would happen if he lived longer than his wife.

The charities naturally claimed that the intention was clear, they should have been the beneficiaries of the estate (worth $5 million). But relatives of Mr Duke claimed that there was no plan for what would happen if the wife was to pre-decease Mr Duke, so he effectively dies without a Will. The courts initially ruled in favour of the relatives, but the supreme court overturned this with a judgement of common sense.

The Supreme court ruled that the Will may be changed “to conform to the testator’s intent if clear and convincing evidence establishes that the will contains a mistake in the testator’s expression of intent at the time the will was drafted, and also establishes the testator’s actual specific intent at the time the will was drafted.”

In other words, it was obvious what Mr Duke intended, even if this wasn’t accurately expressed in his Will. A refreshing, common sense ruling which is becoming more popular in many jurisdictions.

Some challenges in thinking of alternate scenarios.

For many families, alternate scenarios are easy to think through. “If something happens to me, then it will all go to my spouse, and if something happens to both of us at the same time, then it will be divided equally between our children”

The difficulties come from families that don’t follow that common structure. Couples with no children often have to think quite hard when preparing a do it yourself Will. For example you may want to leave everything to your spouse, and create mirror Wills that name each other as the main beneficiary. But with no children of your own, the alternate scenario may involve nephews and nieces. So each partner may name their own extended family to share the estate equally. But what would happen to one nephew’s share if they were unable to receive their bequest, would it go back into the pot, or does that nephew have family of his own?

If there are more relatives on one side of the family than the other, would each person share equally, or would the two sides of the family divide their half between them.

Also keep in mind that your alternate plan cannot depend on your spouse’s Will. This Will can easily be changed, particularly if your spouse moves onto another chapter of their life and starts a new relationship.

These may be unlikely scenarios, but any well written do it yourself Will must cover every possible scenario of people dying in different sequences based on the assumption that the Will is not updated after a beneficiary has died. This can be a little challenging in some family structures when using a do it yourself Will.

Clearly, using a Will writing service like the one at USLegalWills.com it is easy to update your Will as soon as anybody named in the document has a change of circumstance or dies. But this is not always possible, so the document must be able to handle every scenario.

The service at USLegalWills.com however will not allow you to create a Will that doesn’t cover all permutations. To the point that our customer support team often talk people through quite unlikely circumstances, which can often seem a little macabre “but what if your entire family died in a plane crash…”.

6. You didn’t sign your do it yourself Will correctly

This is without doubt the most common error made in a do it yourself Will. Most recently this case highlighted what can happen.

When Jill Widman’s cousin died this year, she discovered one signature kept his hand-written will from being followed.“What bothers me the most is that I can’t follow his wishes,” Widman said.

In this case, the coroner found Kruger’s hand-written wishes on a do it yourself Will.

“This is the final will and testament of Gary William Kruger,” the will reads. “Assets will be divided as follows: Jill Widman, cousin: house and checking account.”. The Will had been notarized, but there were no signatures of witnesses.

So although Mr Kruger took the do it yourself Will approach, his notary somehow didn’t realize that the Will was missing witness signatures. What makes this particularly sad is that the Will was written entirely by hand, so in Alaska, Arizona, Arkansas, California, Colorado, Idaho, Kentucky, Louisiana, Maine, Michigan, Mississippi, Montana, Nebraska, Nevada, New Jersey, North Carolina, North Dakota, Oklahoma, Pennsylvania, South Dakota, Tennessee, Texas, Utah, Virginia, West Virginia, and Wyoming the Will would have been accepted as a perfectly legal holographic Will….but not in Minnesota or Wisconsin.

Unlike the common sense ruling from the California Supreme court above, the courts in Minneapolis decided to completely ignore My Kruger’s obvious intentions and punish him for not following the letter of the law. Because the Will was thrown out, the estate went to Mr Kruger’s nieces through intestate distribution laws. “Kruger’s nieces could have followed what was written in the will, but their lawyer says they chose to follow the law.” A classic case of greed trumping integrity.

So what are the signing requirements of a do it yourself Will?

It is really very straightforward and not something to be afraid of. The legal profession will latch onto cases like this, and as with this same article, they state;

After seeing countless mistakes, Katie Maier, a financial planner recommends people always consult with an attorney who specializes in estate planning first rather than writing a will yourself, or using software online.

But what if I was to tell you that if you are using a do it yourself Will, in order to make the Will a legal document it must be signed in the presence of two adult witnesses who have nothing to gain from the contents of the Will. In other words, next time you have a dinner party with friends, take out your document, tell them you are signing your Will, let them watch you do it, and then have them sign next to your signature on the last page.

It really isn’t so difficult that only a seasoned estate planning professional can figure it out.

As long as your witnesses are adults and not beneficiaries in the Will (and to be on the safe side, make sure they are not the spouse of a beneficiary), and the three of you sign the document in each other’s presence, you have made your document a legal Last Will and Testament. There is no requirement to have the document notarized to make it a legal Last Will and Testament. This is an optional step.

We would therefore counter that Mr Kruger’s unfortunate error is not an indication that everybody should avoid using do it yourself Will services. It is an error that is quite easily avoided.

So, should you steer clear of a do it yourself Will?

Some of these errors are easy to avoid, for example, signing the Will, or attempting to list your assets. Others are very common when you are trying to write your Will starting with a blank sheet of paper or using a do it yourself will kit based on blank forms.

However, using a Will writing service like the one at USLegalWills.com we will not allow you to make many of these mistakes. You will be warned by the service if you attempt to disinherit a dependent or family member. You will not be able to create a Will without a residual clause using our service. You have to cover all alternate scenarios using the service at USLegalWills.com otherwise your Will is incomplete and it will not be generated.

You’ll notice that the examples presented here are mistakes made when taking a do it yourself Will approach, but either with a handwritten Will, or using a blank form kit. Saying “do it yourself Will” also includes online interactive services like USLegalWills.com which are significantly better and do not allow most of these errors to be made.

When the legal profession broadcast these cases of mistakes being made with a do it yourself Will, they typically claim “this person didn’t sign their Will correctly, which shows why it’s so important to hire an professional attorney to prepare your Will.” But one doesn’t necessarily follow the other.

Online Will services like the one at USLegalWills.com will not allow you to make these mistakes. And although other people have made mistakes when handwriting their own Will, you shouldn’t let their experience discourage you from a do it yourself Will. But you should not use a blank form Will kit or attempt to write your Will starting with a blank piece of paper.

It really isn’t difficult now that you know the most common errors, and we strongly believe that in most cases, there is no justification in paying several hundreds of dollars to prepare your Will through a lawyer. As long as you use an intelligent, interactive service like the one at USLegalWills.com you can prepare a well drafted, legal do it yourself Will.

- Testamentary Trusts – what are they and how are they created? - May 9, 2024

- Every document you need for a complete estate plan. - October 29, 2020

- Estate Planning in troubled times - April 3, 2020