A number of surveys over the last few years have reported that anywhere from 55 percent to 64 percent of Americans have not written their Wills. However, one under-reported statistic is the number of people who have their Will in place, but made it so long ago, that it no longer reflects their current circumstance. At USLegalWills.com we wanted to explore the current state of Will writing in the US, and delve deeper into the issue of outdated Wills.

Executive summary

The USLegalWills.com survey was conducted within the United States by Google Consumer Surveys, June 2016, among 2,012 adults aged 18 and older, and has a root square mean error of 1.4%.

Results are weighted by age, gender, and region. For full information on Google Consumer Surveys’ methodology and validity, visit here.

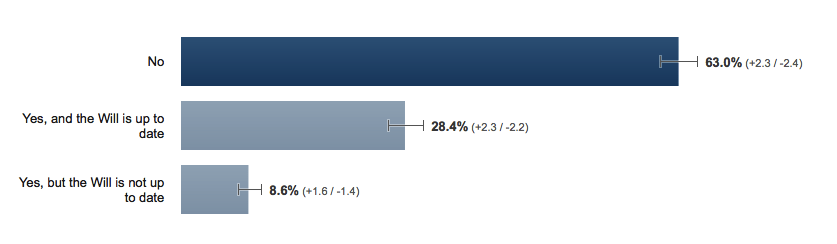

- Across all age groups 28.4 percent of Americans had up-to-date Wills. 8.6% had a Will but it was out-of-date. 63% had no Will at all. This means that 71.6 percent of Americans do not have an up-to-date Will.

- Even when we focus on Americans over 35, two thirds don’t have an up-to-date Will.

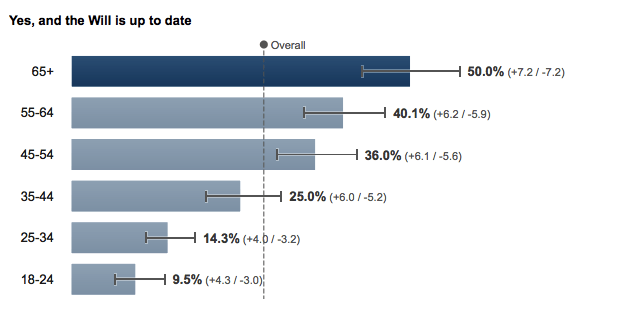

- Only half of Americans over the age of 65 have up-to-date Wills in place.

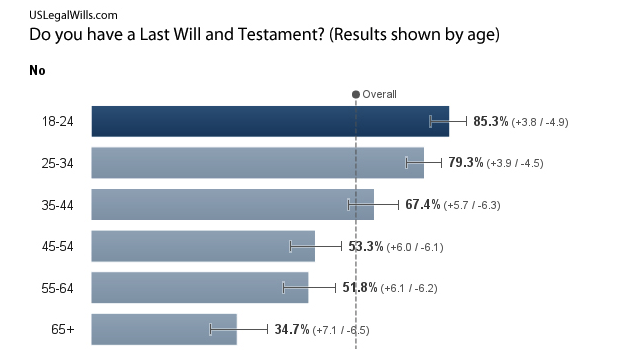

- One in six Americans over the age of 65 have a Will that is out of date.

- Wealthy Americans are no more likely to have written their Will.

- Wealthy Americans are more likely to have an out-of-date Will.

Number of Americans without Wills

Our aggregated numbers show that 71.6 percent of Americans do not have an up-to-date Will. We rarely see the number of out-of-date Wills reported, but it makes a significant difference to the story and clearly demonstrates that there are significant improvements needed in the way that Will writing is presented to Americans.

We know that everybody needs a Will, and consistently over the years we’ve heard that around two thirds of Americans don’t have their Wills in place, but now knowing that nearly ten percent have an out-of-date Will adds to this concern.

Number of Americans over the age of 35 with a Will

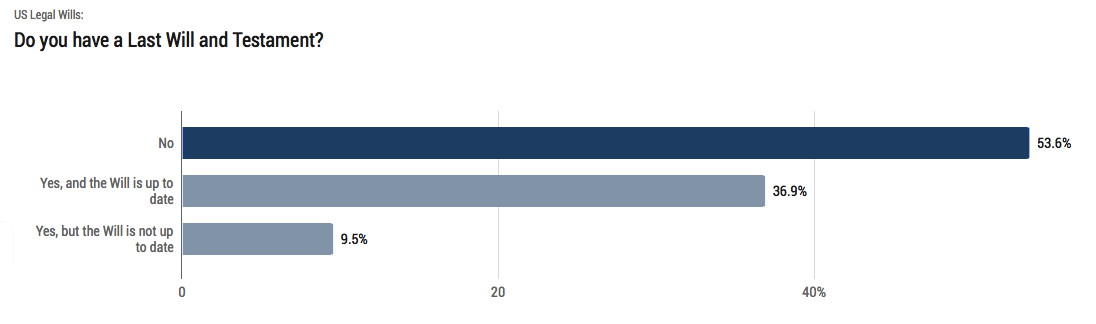

Those least likely to have a Will, according to our survey are adults aged 18-35. Although we feel that this group should still have a Will, it is perhaps understandable that a large proportion of young adults have not written their Will. Because of this, we recalculated the data based on the responses of only the population over 35.

The results show that even for Americans over 35, only around one-third have an up-to-date Will in place. And the number of Americans with out-of-date Wills creeps up to around 1 in 10.

Number of Americans with a Will (by Age)

Not surprisingly, the percentage of adults with a Will in place increases with age, but the numbers are still low. Even within our senior population, exactly half have an up-to-date Will in place.

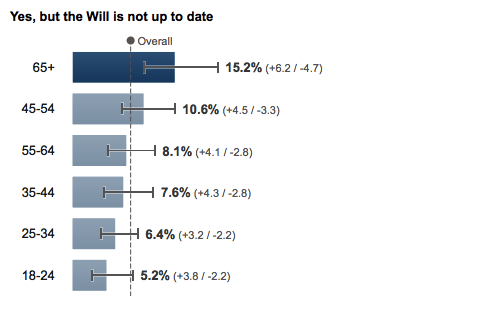

Number of Americans with out-of-date Wills (by Age)

One of the surprising pieces of data to come out of this survey is the number of Americans with out-of-date Wills. Many people write a Will hoping that it will last a lifetime, but changes in family situations like marriage, divorce, births and deaths can all render a Will obsolete at best, and actually quite troublesome if not updated. We know from our customer service calls, that people are sitting on Wills that are decades old and although they are technically still the legal Last Will and Testament, they no longer reflect the testator’s wishes. Oftentimes they omit children or fail to take into account a child becoming an adult and starting a family of their own.

Our survey revealed that around one in six American seniors have an out-of-date Will that no longer reflects their wishes. But these Wills have not been destroyed; these respondents reported that they did have a Will in place, but it was not up-to-date. A very worrying statistic.

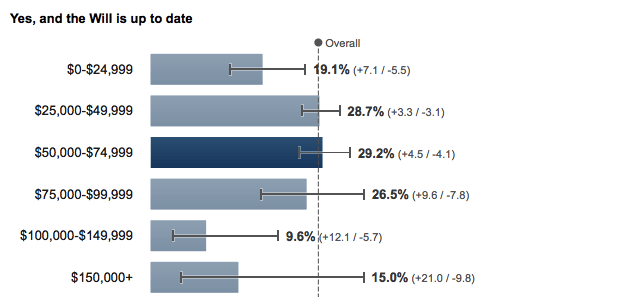

Number of Americans with an up-to-date Will (by Income Level)

Most of us associate the need for a Will with the acquisition of assets. One of the most commonly cited reasons for not having a Will is that “I don’t have anything to leave”. The distribution of assets is of course only one part of the reason for preparing a Will, but given this excuse, it would be natural to assume that those with assets would be more likely to prepare their Wills.

However, according to our data, the Americans with the highest income level are no more likely to have an up-to-date Will in place. In fact, in the income bracket of $100k-$150k only 10 percent of respondents had an up-to-date Last Will and Testament. Even if we account for some statistical variability, that number seems astonishingly low. One of the reasons for this is explained in the next section.

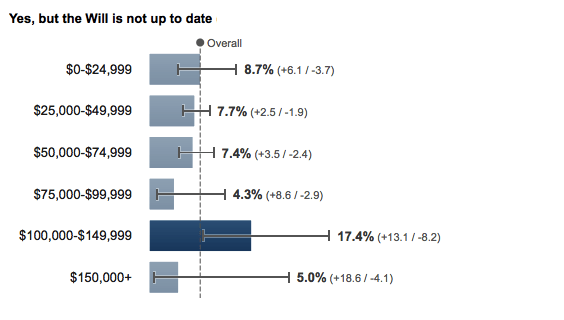

Number of Americans with an out-of-date Will (by Income Level)

How can it be that so few wealthy Americans have an up-to-date Will? The answer lies in the number of outdated Wills.

Nearly one in five Americans earning between $100k-$150k have an out-of date Will. There are a number of possible reasons for this. It is possible that this group is experiencing more changes in their lives and have not been able to keep up with their changes in personal and financial situation.

It is also possible that this group has been steered away from using the more convenient tools for preparing a Will like an online Will writing service, and have instead taken a more traditional Will writing approach, typically involving an estate planning attorney. Sadly, the more traditional Will writing services are inherently inconvenient and expensive and so updating a Will is far more troublesome.

What does our survey tell us?

People don’t understand why they need a Will

The four most common excuses for not preparing a Will are listed below and we will explain why they are dangerous misconceptions. What most people fail to understand is that writing a Will is really not about you at all. It is about helping your loved ones at a time when they are most vulnerable. If you cared at all about your family, you would not put them through the administrative turmoil that comes with dying intestate.

1. “I don’t have any assets, so I don’t need a Will”

You are not writing a Will to come into effect today, your Will is more likely to sit in a drawer for many years. You have absolutely no way of predicting the size of your estate when you die, and in fact, you can be worth much more after you have died than you ever were alive.

Supposing your death was an accident, and somebody was held responsible. There is a good chance that there would be some level of accidental death compensation and that compensation would go to your estate. Suddenly, the amount being distributed according to the directions in your Will is several millions of dollars.

This is one of the reasons why you never attempt to list your assets in your Will. You don’t know when your Will is going to come into effect, and you have no idea what assets will be in your estate when you die. But, everybody needs a Will, even if you do not have a penny to your name today.

2. “I’m not even old yet”

You may be, like many people, planning to write your Will just before you die.. It’s a bad idea.

The obvious downside of waiting until you are close to death is that you probably won’t know that you are close to death. Remember the Nickelback video? for Savin Me, when the main character could see the numbers over everybody’s head counting down to their death? A wonderful concept, that might make us all live our lives more fully, but of course, the reality is that we don’t know when we are going to die.

Furthermore, you have to write your Will when you have mental capacity. So waiting until you are very old, or diagnosed with a terminal illness is not the best time to be considering these weighty issues. Your Will should be written while you are young and healthy and then updated throughout your life as your circumstances change.

3. “It’s obvious who will be receiving my things anyway”

This is actually highly unlikely, because every State has its own rules for distributing your estate if you have no Will. Let’s suppose that you have a spouse and two children. In Alabama your spouse inherits the first $50,000 of your estate, plus 1/2 of the balance of your estate, and your children inherit the other half. In Alaska, the spouse would receive everything, unless your spouse had children from another relationship, in which case they would receive the first $150,000 plus half of the balance.

As you can see, it isn’t simple, and it is a misconception that everything will automatically pass to your spouse.

4. “I’m going to wait until <this event happens> before preparing my Will”

We are often asked the question; “I am expecting a child next year, should I wait until then to prepare my Will?”

The problem with that strategy is that your life will never reach a point of “no change”. Throughout your life you could have changes in marital status, you may have children, and you will almost certainly have ebbs and flows in your financial status. The answer is that you should write your Will today, and update it whenever there is a change of circumstance.

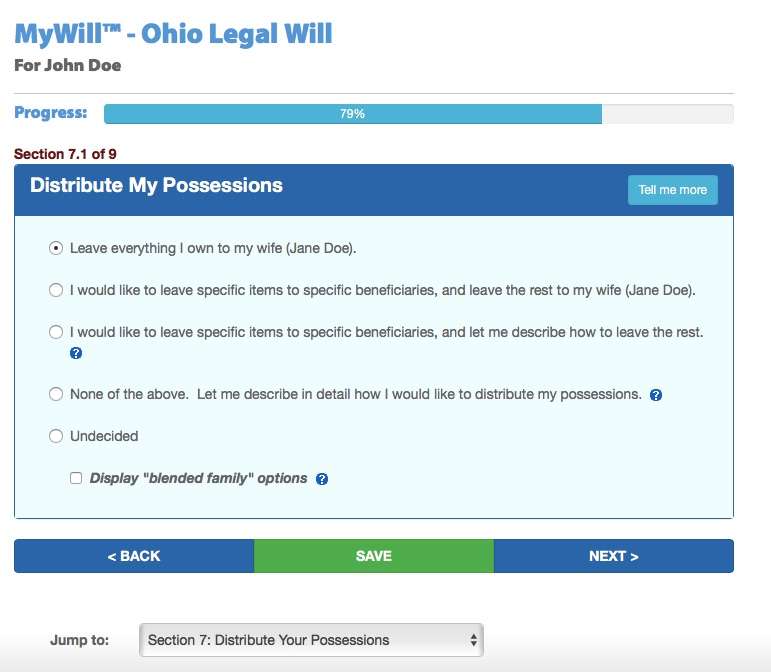

Writing a Will is considered more difficult than it actually is

Two thirds of Americans over the age of 35 don’t have a Will in place, but most know that it is a critical document. The most obvious conclusion to be drawn is that people think it is a bigger process than it actually is. If everybody knew that a Will could be created in about 20 minutes, for less than $35, then I think we would see more people writing Wills.

The most difficult part of the Will writing process is making decisions about the key appointments, and the distribution of the estate. Once these decisions have been made, the actual process for writing a Will is very simple, in fact, far more straightforward than filing your taxes.

Using the service at USLegalWills.com we guide you through 9 sections. You don’t have to write any legal language, you simply answer the questions and select from the options presented to you. At the end, you download and print your document, and then sign it in the presence of two adults who are not beneficiaries in the Will. It really can be finished in under half an hour.

Traditionally, the barriers to updating a Will are too great

Fifteen percent of Americans over the age of 65 have out-of-date Wills. When we asked the question we were probing to see how many Wills were rendered ineffective because of a change in family status. But this doesn’t even include more subtle changes that a person may want to make, but chooses not to, simply because it’s not worth the hassle.

For example, you may develop an association with a charity and want to acknowledge that charity in your Will. If you just wanted to add a $1,000 bequest the process of updating a Will can be time-consuming and expensive. Chances are, you wouldn’t bother making an appointment with an estate planning attorney to make that one update.

Fortunately, online Will writing services remove the barriers to updating Wills, and allow you to simply login, make the change and print the new Last Will and Testament.

We are hoping as more people move to convenient online services, the number of out-of-date Wills decreases.

Finding the time to prepare a Will is as critical as finding the money

One of the surprising statistics from the survey was that more affluent Americans were no more likely to have written their Wills. This suggests that the cost of creating a Will is less of an issue than finding the time to prepare a Will.

Traditionally, it would require booking an appointment with an estate planning attorney, usually during office hours, at a time that can be co-ordinated between spouses.

For new parents, writing a Will is especially critical, as you are able to name guardians and set up trusts for minor beneficiaries. But it is very difficult for new parents to arrange childcare, and then book an appointment that works for both parents to visit the office of an estate planning attorney. So the Will goes unwritten, or at least, is not updated.

There may be a few estate planning attorneys who offer house visits, but not many, and usually at quite a premium.

Traditional Will writing services are no longer compatible with the lifestyles of professional families.

We don’t explain why Wills can actually be cool!

Over seventy percent of Americans are missing a great opportunity to do wonderful things in their Will. If you don’t write a Will, your estate is distributed according to your State “intestate” laws. Sadly, this means that nothing will go to a charity, and none of your friends will receive anything.

You can do some wonderful things in a Will. You could for example leave some money to a local children’s hospital or sports team. Or give Christmas dinner to the homeless in your town. You could buy your favorite niece an around-the-world plane ticket. You could pay for a child’s education, or create a scholarship fund. You could have hundreds of trees planted in your memory. You could give your treasured Michael Jordan signed basketball to your best friend Joe.

The list goes on.

Your Will is a wonderful opportunity to express your love for all of the people and causes that have been a part of your life.

People are still scared into avoiding online Will services

If the process for writing a Will is so simple, why do most people not have a Will? It is a puzzle, but one reason is that the legal profession scare people away from using online interactive services. They group these services together with the general concept of “writing your own Will” which is generally a bad idea. They make analogies of writing Wills to other professions where the comparison makes no sense.. Countless times I have read:

“You wouldn’t perform surgery on yourself, so why would you prepare your own Will?”

The two tasks are nothing close to equivalent.

Writing your own Will by starting with a blank sheet of paper is a terrible idea. Writing your own Will using a blank-form Will kit that you buy from Staples isn’t much better.

But using an Will writing service like the one at USLegalWills.com is not the same. We use the exact same software used by estate planning attorneys across the US, so the end result is likely to be word-for-word the same as if you walked into a lawyer’s office. The only difference is that we are a fraction of the price, and you can start right now, from your comfortable chair, on your laptop, iPad or smartphone.

Please don’t be like the seventy percent of Americans without a Will. Take the 30 minutes now to protect your family, protect your loved ones and show them that you care.

- Testamentary Trusts – what are they and how are they created? - May 9, 2024

- Every document you need for a complete estate plan. - October 29, 2020

- Estate Planning in troubled times - April 3, 2020